Struggling to find the best project management software for your accounting team? With so many options, where do you start? We’ve tested and reviewed 85 leading solutions to spotlight the top 11 picks based on needs like workflows, security, and ROI.

Read on for the quick list of recommendations to accelerate your search.

Quick List of 11 Accounting Project Management Software

- Quickbooks Online: Best for small businesses that need basic accounting and invoicing features.

- Wrike: Best for project managers and teams who need to collaborate on projects and track tasks.

- NetSuite: Best for large businesses that need a comprehensive ERP system with accounting, CRM, and other features.

- R4 Enterprise: Best for enterprises that need a highly customizable ERP system with advanced features.

- Asana: Best for teams and individuals who need a simple and intuitive task management tool.

- Trello: Best for teams and individuals who prefer a visual Kanban board for managing tasks.

- ClickUp: Best for teams and businesses that need a more powerful and customizable task management tool with automation features.

- FreshBooks: Best for small businesses and freelancers who need basic accounting and invoicing features.

- Accounting Seed: Best for small businesses that need a more robust accounting system with inventory management.

- Xero: Best for small businesses that need a cloud-based accounting system with payroll features.

- Financial Cents: Best for small businesses that need a simple and affordable accounting system.

PS: Those who know what project management software for accounting is and its benefits, skip to the top 11 project management software for accounting.

Our reviewers evaluate software independently. Clicks may earn a commission, which supports testing. Learn how we stay transparent & our review methodology

What is Accounting Software For Project Management?

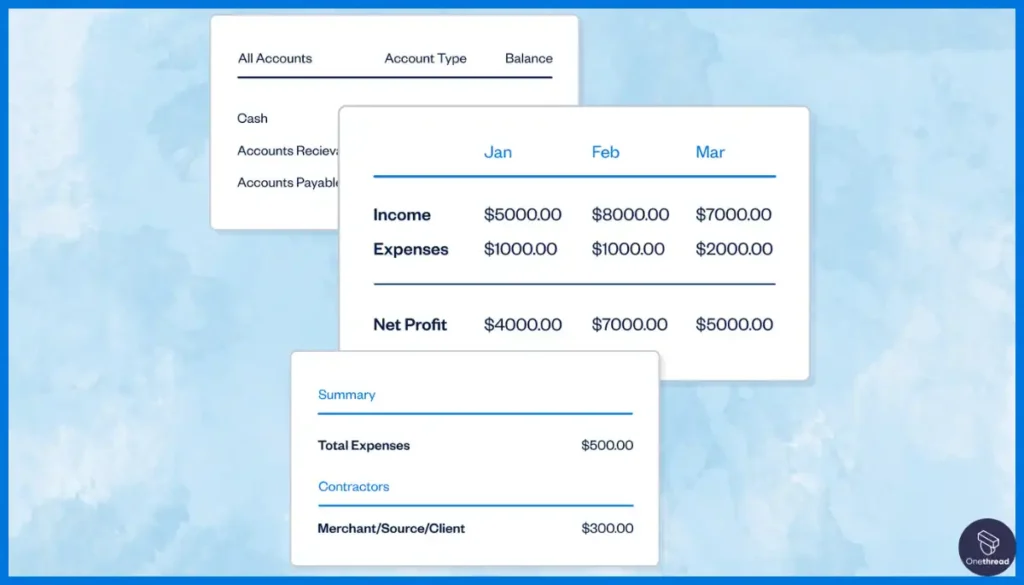

Accounting project management software integrates financial tracking within project management systems. It enables the tracking of project costs, budget allocation, and resource expenses in real-time, while also incorporating critical compliance features like AML Verification to prevent financial crimes and ensure adherence to legal standards.

This software combines traditional accounting functionalities with project management tools, streamlining financial aspects such as invoicing, billing, and expense management.

Key features include budget tracking, expense categorization, profit analysis, and financial reporting. It ensures adherence to budgets, facilitates accurate cost estimations, and aids in forecasting financial outcomes.

This data fusion optimizes project planning, allowing teams to align financial goals with project objectives. With synchronized accounting and project data, stakeholders gain insights into the financial health of projects, enhancing decision-making for better resource utilization and project profitability.

Advantages of Using Accounting Software For Project Management

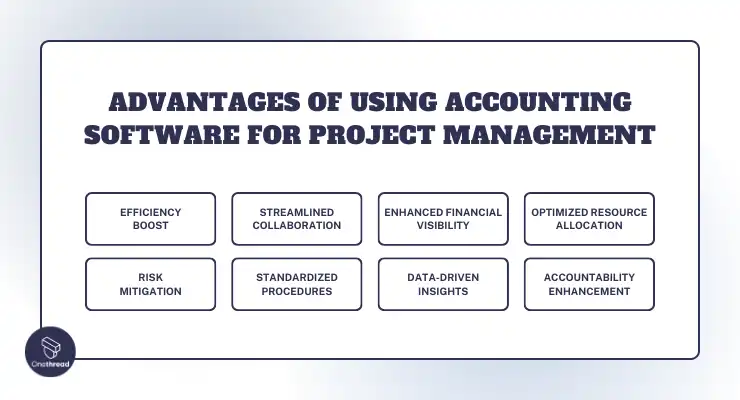

Accounting software integrated with project management offers numerous advantages, such as:

- Efficiency Boost: Automates administrative tasks like expense tracking, invoicing, and financial reporting, optimizing productivity.

- Streamlined Collaboration: Provides a centralized platform for teams and stakeholders to communicate, share financial data, and track progress, irrespective of location.

- Enhanced Financial Visibility: Offers real-time tracking and reporting, providing insights into budgets, expenses, and financial risks.

- Optimized Resource Allocation: Efficiently schedules and manages people, budgets, and resources across multiple projects, ensuring optimal utilization.

- Risk Mitigation: Identifies potential financial issues early through analytics and reporting, minimizing risks and enabling proactive decision-making.

- Standardized Procedures: Ensures consistency by standardizing financial and accounting processes across all projects, fostering best practices and compliance.

- Data-Driven Insights: Utilizes reports, analytics, and dashboards to derive actionable insights, aiding informed decision-making and project success.

- Accountability Enhancement: Tracks and measures individual and team contributions, promoting accountability and clarity in deliverables and expectations.

Accounting integrated with project management not only enhances work execution, cost efficiency, and timeliness but also ensures better governance across project portfolios.

Top 11 Accounting Software For Project Management

Here’s a concise overview of the top financial software integrated with project management.

Software | Top Features | Best Suitable For | G2 User Ratings (out of 5) |

| Modern interface Approval system Task dependencies Advanced financial reporting | Small to mid-sized teams | 4.0 |

| Work management Robust project accounting sync collaboration | Large enterprises | 4.2 |

| Scalability Comprehensive accounting functionalities comprehensive tools | Growing businesses | 4.0 |

| Customizable dashboards | Diverse project teams | 4.4 (Capterra) |

| Project tracking Integrated accounting for cohesive management team workflows | Agile teams | 4.3 |

| Visual task boards Financial tracking with accounting sync simplicity | Freelancers, small teams | 4.2 |

| All-in-one project management Efficient project financial oversight | Remote teams | 4.7 |

| Workflow automation Unified project and finance management | Creative agencies | 4.5 |

| Time and expense tracking Robust project-centric financial management | Professional services | 4.1 |

| Integrated project and accounting oversight, modular design | Flexible business models | 4.3 |

| Specialized accounting tools Expense tracking invoicing | Finance-focused businesses | 4.7 |

Let’s explore how these software options can elevate your projects.

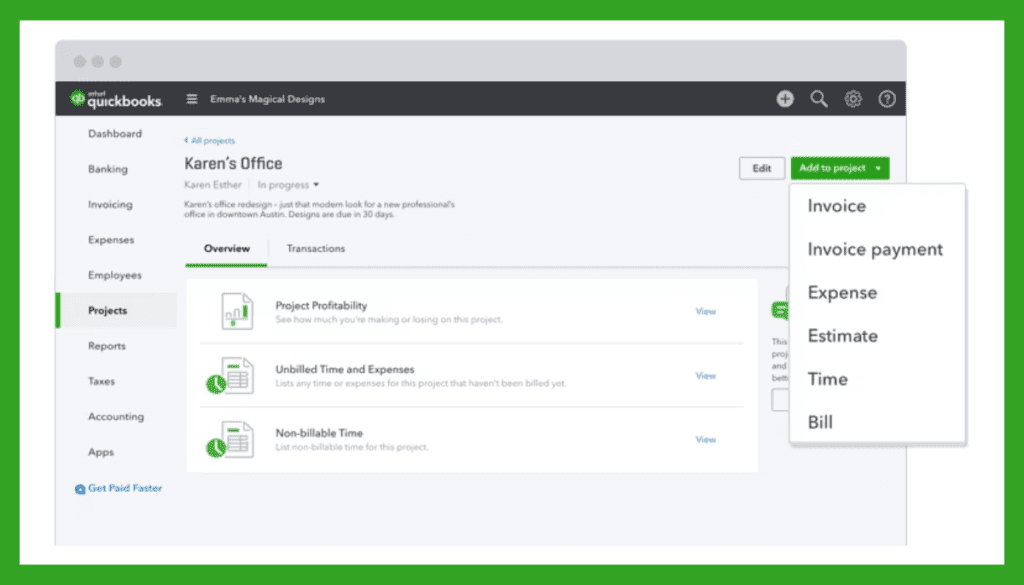

1. QuickBooks Online

All-in-one accounting hub for all kinds of business.

Quickbooks stands out as another excellent financial software for project management, offering crucial features such as comprehensive reporting, expense and time tracking, and efficient invoicing capabilities essential for streamlined project accounting.

Our review team found that its user-friendly interface and seamless integration with other business tools proved advantageous, facilitating smoother project oversight.

However, in comparison to NetSuite, Quickbooks may lack scalability for larger enterprises due to limited customization options and advanced project management tools.

Moreover, while suitable for small to mid-sized businesses, its complex functionalities might require some acclimatization, potentially affecting ease of use for beginners.

Despite these limitations, Quickbooks remains a robust choice for businesses seeking integrated project management and accounting solutions

Key Features

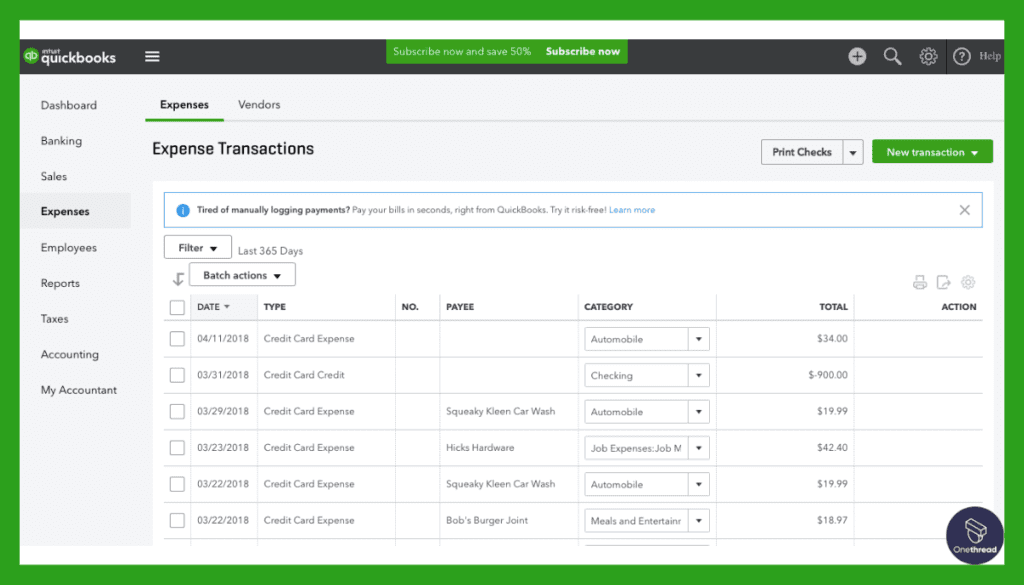

Income and Expenses Tracking:

QuickBooks Online allows you to import transactions securely. It organizes your finances automatically. This feature is crucial for everyone who needs to keep an eye on their income and expenses.

Invoice and Payments:

You can accept credit cards and bank transfers directly in the invoice. QuickBooks Payments provides status updates and reminders, making it easier to manage your cash flow.

Tax Deductions:

Share your books with your accountant or export important documents. This feature simplifies the tax process, making it less stressful during tax season.

Mileage Tracking:

The software automatically tracks miles and categorizes trips. It even provides sharable reports, which is beneficial for everyone who travels for work.

Project Profitability:

Track all your projects in one place. Monitor labor costs, payroll, and expenses. This feature is a game-changer for individuals who manage multiple projects.

Pros:

- User-friendly interface

- Comprehensive financial reports

- Secure data encryption

- Excellent customer support

Cons:

- Can be expensive for small businesses

- Limited customization options

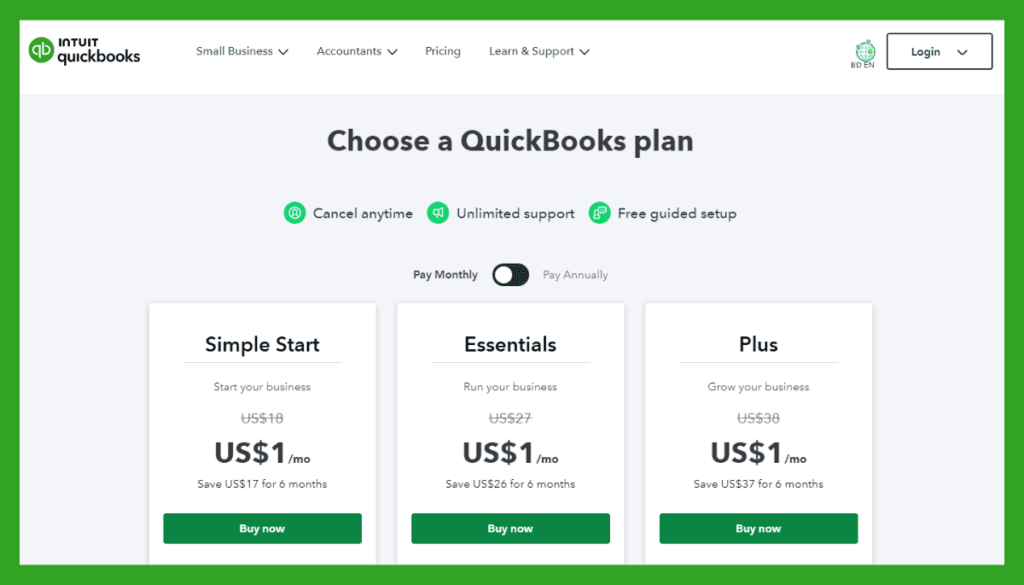

Pricing Plans

- Simple Start: $15/month

- Track income and expenses

- Send invoices

- Essentials: $30/month

- Manage bills

- Track time

- Plus: $45/month

- Inventory tracking

- Project profitability

- Advanced: $100/month

What Users Say About Quickbooks Online?

G2 Review: 4.0/5

Positive Review

I use QuickBooks pretty much daily. I like that I can connect our business checking account. I also like that it remembers the categories of items that have been entered before. It’s great that it can create all sorts of reports. The best thing is it integrates with the payroll module that we use. Laura D.

Critical Review

I still find QuickBooks Desktop a little easier to use for bookkeeping and financial reporting but for customer invoices and payments QuickBooks Online is the way to go. John I.

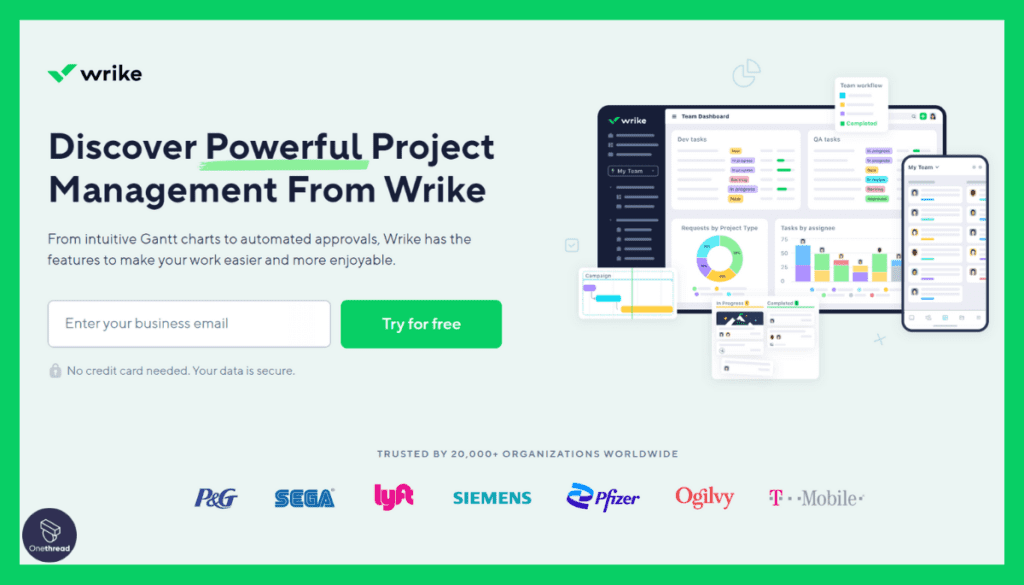

2. Wrike

Cross-functional portfolio coordinator.

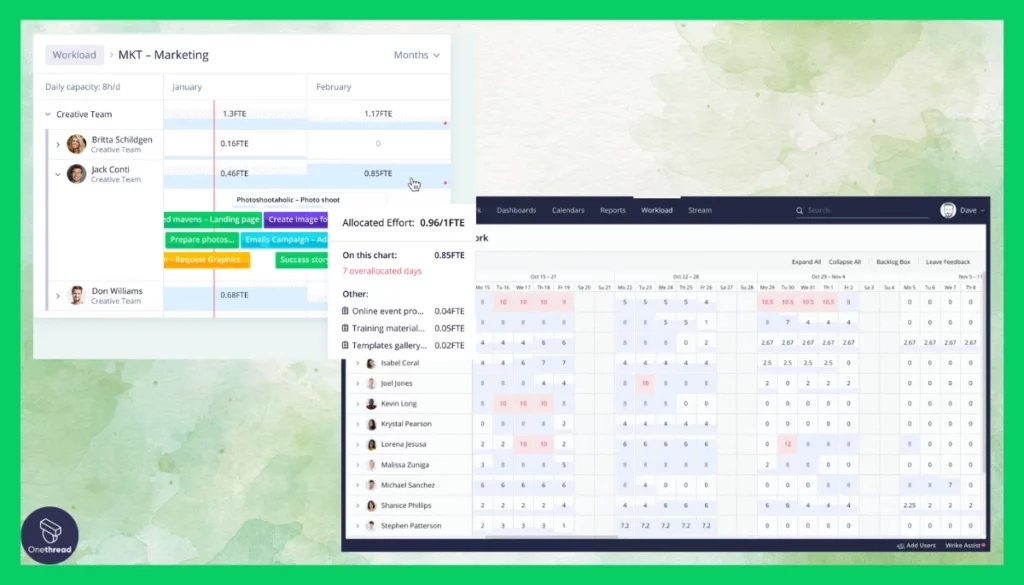

Wrike stands out as a top project management software for accountants, offering essential features vital for effective project financial tracking.

During our analysis, we found Wrike to excel in areas crucial for project accounting, including robust budget tracking, expense management, real-time financial insights, and customizable reporting.

Its intuitive interface simplifies cost allocation, facilitating precise budget estimations and resource utilization.

Its collaborative platform enables teams to align financial goals with project objectives, enhancing overall project profitability.

Wrike’s comprehensive approach to project accounting, coupled with its user-friendly interface and diverse functionalities, solidifies its position as a leading choice for managing project finances efficiently.

Features

Efficient Work Management:

Wrike’s platform enables easy task assignment, progress tracking, and real-time collaboration for accounting-related tasks.

Seamless Financial Integration:

Wrike integrates with accounting tools for direct financial tracking within project management, ensuring accurate expense monitoring.

Tailored Financial Reporting:

Wrike offers customizable reports for detailed financial insights, aiding decision-making and financial transparency.

Optimized Resource Allocation:

It provides smart scheduling and workload balancing, optimizing resource use, crucial for accounting projects with specific deadlines.

Pros of Wrike:

- Efficiently manage accounting tasks and deadlines.

- Enhance team collaboration with shared workspaces.

- Tailor processes to suit accounting needs.

- Integrate with financial software for analysis.

Cons:

- Advanced features might strain budgets.

- Overwhelming for smaller teams or simpler projects.

- Requires a stable internet connection.

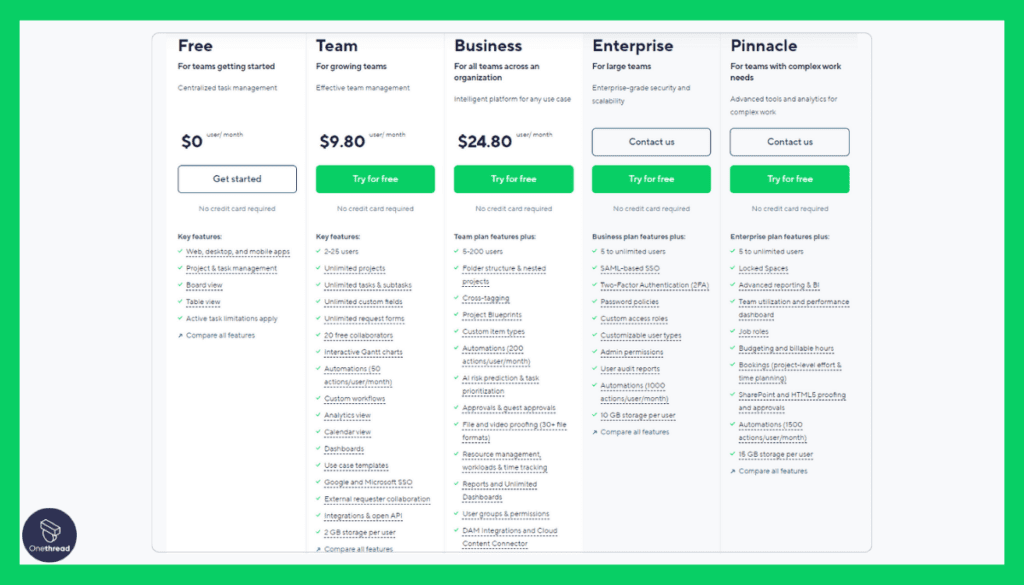

Pricing

- Free: $0

- Team: $9.80/user/month

- Business: $24.80/user/month

- Enterprise: Custom

- Pinnacle: Custom

What Users Say About Wrike?

G2 Review: 4.2/5

Positive Review

It’s easy to use and allows us to stay on top of projects. I love the dashboard feature, and working within the projects is straightforward. Our company switched from a competitor, and Wrike was definitely the better choice. I don’t see how companies could stay on top of projects without it! Lindsey F.

Critical Review

We dislike that there is no dark mode, that you cannot assign tasks to a dummy account or role type for people with no access or who do not exist yet, that you can’t view projects on the Kanban board (only tasks), and that skins/themes for the UI are severely lacking (especially with the lack of dark mode). Kelly-Anne S.

3. Oracle NetSuite

Automated financial controller for enterprises.

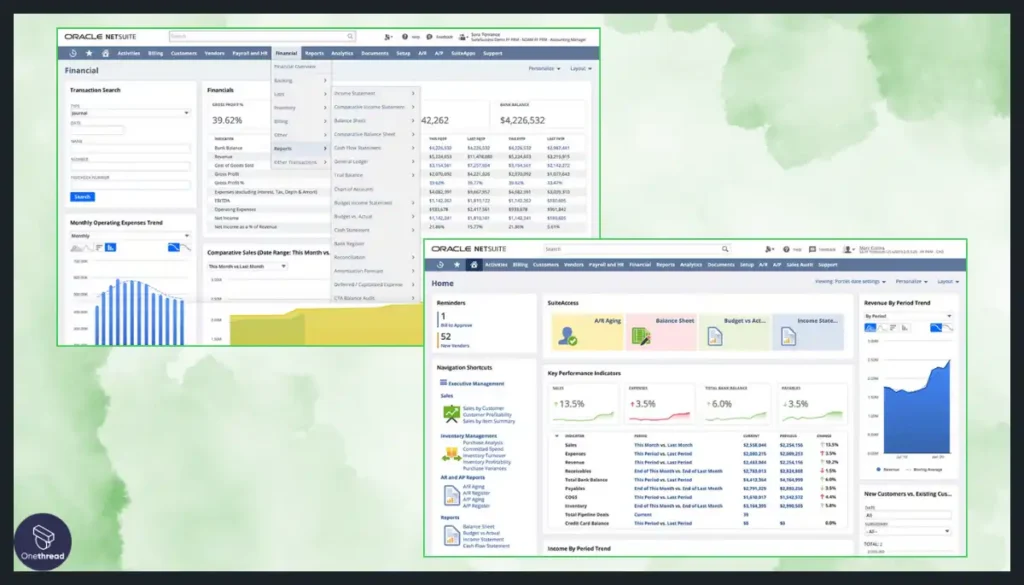

NetSuite stands out as a top-tier accounting software for project management, delivering essential features vital for streamlined operations. It excels in key areas: robust financial document management, extensive reporting capabilities, and seamless data fusion with project tools.

Throughout our testing, NetSuite showcased exceptional adaptability, catering to various business needs while ensuring accurate insights through unified financials and project data.

Its real-time collaboration tools facilitate efficient team communication across projects, supported by customizable dashboards that offer comprehensive project overviews. However, the initial setup complexity might necessitate professional assistance.

NetSuite’s integrated approach and versatile functionality make it a standout choice for project-centric accounting tasks, empowering businesses with comprehensive solutions.

Features

Here are standout features:

Comprehensive Financial Management:

This fusion allows for real-time financial tracking within project workflows. Expenses, revenue recognition, and budgeting become synchronized, providing holistic insights crucial for project success.

Project Accounting:

Its specialized project accounting module enables tracking project costs, resource utilization, and profitability in real-time. This feature streamlines project financials, allowing for accurate budgeting, forecasting, and billing tied directly to project milestones and tasks.

Scalability and Customization:

NetSuite’s scalability accommodates the growth of businesses, making it suitable for evolving project needs.

Collaborative Project Management:

Beyond accounting, NetSuite provides robust project resource management tools. Teams can collaborate efficiently, track project progress, assign tasks, manage timelines, and share project-related documents seamlessly.

NetSuite Pros:

- Combines accounting, project, CRM, and e-commerce functions.

- Offers extensive financial and project reporting for better decisions.

- Fits businesses of all sizes.

Cons:

- Requires expertise and time for initial configuration.

- Higher expenses due to licensing and customization.

- Users may need training for optimal usage.

Pricing

Oracle Netsuite has multiple custom pricing.

What Users Say About NetSuite?

G2 Review: 4.0/5

Positive Review

I like that you can customize almost every business process/workflow in NetSuite to fit your unique business needs. They provide methods for both technical and nontechnical people to make these customizations. Shane B.

Critical Review

Renewals can be tough. That’s why we encourage new clients to book five-year licenses with pre-agreed not-to-exceed renewals. Gene H.

4. R4 Enterprise

Customizable ERP for manufacturers.

R4 Enterprise, as a stellar financial software for project management, delivers indispensable features crucial for efficient operations, customizable dashboards, seamless collaboration, detailed reporting, and robust task management capabilities.

Throughout our rigorous reviewing, R4 Enterprise excelled notably in dashboard customization, allowing tailored views for diverse stakeholders, and enhancing clarity and productivity.

Its collaborative tools facilitated streamlined communication and task assignment, significantly boosting team efficiency.

However, when compared to Asana, R4 Enterprise revealed limitations in third-party data fusions and flexibility within workflow customization, potentially impacting users seeking extensive external data fusions.

Despite these aspects, its robust dashboard personalization and collaborative tools affirm its suitability for businesses emphasizing project-centric operations.

Features

Robust Financial Management:

R4 Enterprise offers comprehensive accounting tools seamlessly integrated with project resource management solutions. It ensures accurate financial tracking, aligning budgets, expenses, and project costs efficiently.

Project-Centric Approach:

With project-specific modules, it enables meticulous tracking of project-related expenses, resource allocation, and revenue recognition.

Resource Optimization:

It optimizes resource utilization by aligning financial data with project timelines. Through detailed insights, it aids in resource allocation, ensuring efficient utilization for maximum project output.

Real-Time Reporting:

The software provides real-time reporting and analytics, offering stakeholders immediate access to project financials. This feature facilitates informed decision-making and swift adjustments to project strategies.

Pros:

- Enhances clarity and efficiency.

- Boosts team productivity.

- Informs decision-making.

- Organizes project tasks effectively.

Cons:

- Falls short in third-party integrations.

- Less flexibility in workflow customization.

Pricing

Has multiple custom pricing models.

What Users Say About R4 Enterprise?

Capterra Review: 4.4/5

Positive Review

Royal 4 has made our warehouse more efficient from beginning to end for processes. Putting away is more organized, which helps for easy time efficient picking. Kadi R.

Critical Review

The aspects I liked least about the software were the reporting build-outs. The reports were not user-friendly and did not communicate what we were looking for in terms of managing the system and displaying metrics that drove efficiency. Ricky C.

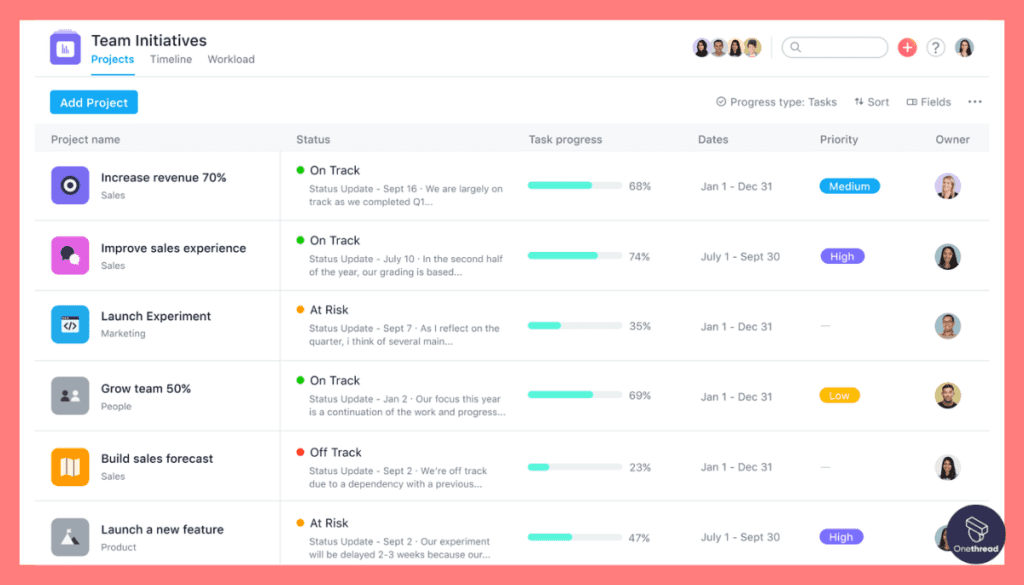

5. Asana

Streamlined task manager just for visibility.

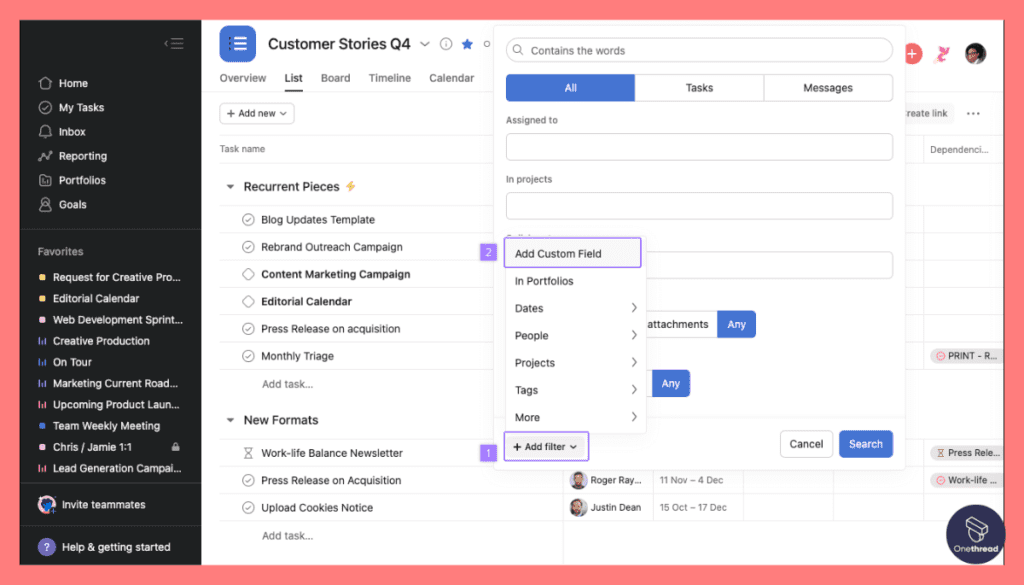

Asana is among the best accounting project management software, offering essential features crucial for effective accounting within projects. Its standout functionalities include Work management, intuitive collaboration tools, time tracking, and customizable dashboards—integral for streamlined project accounting.

Our testing team found, that Asana proved its efficiency in facilitating seamless communication among team members and aligning accounting tasks with project milestones.

However, compared to specialized financial software, Asana might lack extensive financial reporting and in-depth accounting features, potentially requiring data fusions for complex financial tracking.

Nonetheless, for businesses seeking versatile project management solutions with basic accounting functionalities seamlessly integrated, Asana remains a commendable choice.

Features

Collaborative Task Management:

Facilitates seamless task assignment, progress tracking, and team collaboration for efficient project execution.

Task Integration with Financials:

Allows linking tasks directly to financial components, streamlining project accounting team processes.

Budget Tracking and Allocation:

Enables setting and tracking project budgets, aiding in financial planning and resource allocation.

Customizable Workflows:

Offers flexibility in creating custom workflows tailored to specific accounting-related project requirements.

Pros:

- Excellent work management.

- Facilitates team collaboration.

- Integrates with accounting tools.

- Customizable workflows.

Cons:

- Limited accounting features.

- Steeper learning curve.

- Costlier for advanced functions.

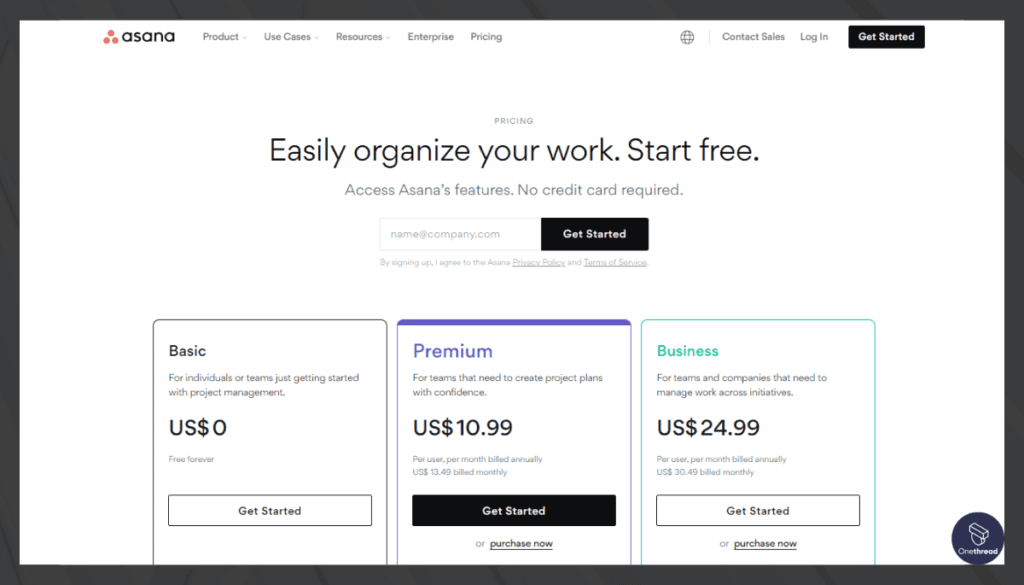

Pricing

- Personal: $0

- Starter: $10.99/user/month

- Advanced: $24.99/user/month

What Users Say About Asana?

Product Hunt Review: 4.6/5

Positive Review

Super decent iOS version of the Asana app, which is most robust on desktop. Adam Hyla E. Holdorf

G2 Review: 4.3/5

Critical Review

We wish there were more of the team functions in the free version. Krista N.

6. Trello

Flexible project organizer.

Trello offers valuable features for simple project management and basic accounting tasks, such as intuitive task organization, collaborative boards, checklists, and customizable workflows.

During testing, Trello’s simplicity and visual interface proved beneficial for straightforward accounting teams within projects, promoting easy task management and team collaboration.

However, compared to platforms like monday.com, Trello might lack advanced reporting tools and comprehensive financial tracking, requiring additional data fusions for complex accounting needs.

Moreover, while suitable for smaller teams and simpler accounting tasks, Trello’s flexibility could potentially lead to complexities when handling intricate financial workflows.

For streamlined project accounting and basic team collaboration, Trello serves as a user-friendly option, although for more robust accounting needs, exploring alternatives might be prudent.

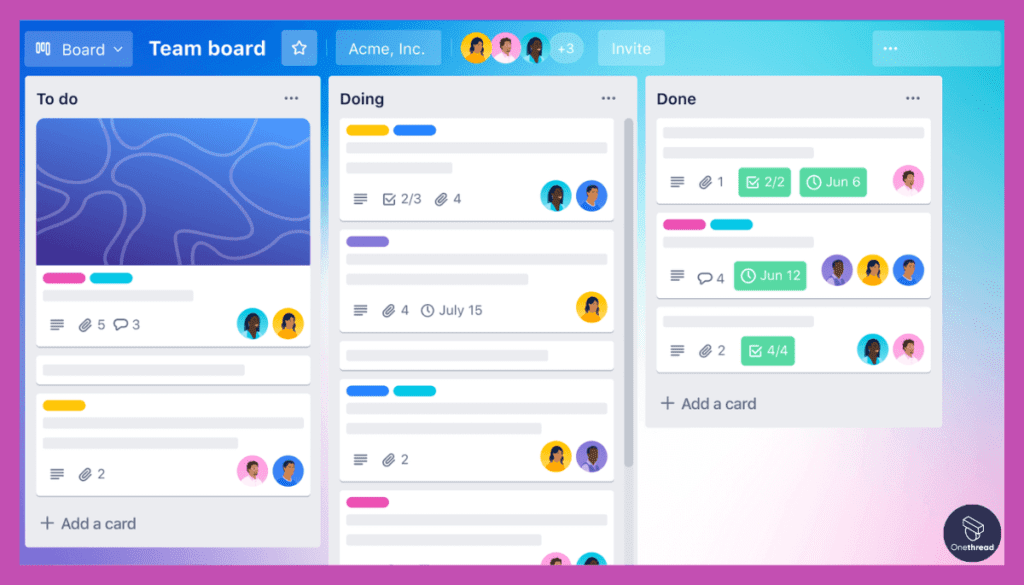

Features

offers valuable features that complement accounting-centric project management:

Work Management & Tracking:

While not a direct accounting tool, its customizable workflows enable teams to track financial tasks, invoices, and budgeting activities efficiently.

Collaboration & Transparency:

Teams can collaborate seamlessly on accounting projects through Trello’s boards, allowing for transparency in task allocation, progress tracking, and sharing documentation related to financial practice management.

Integration Capabilities:

Trello integrates with various software and tools, like (Google, Evernote, HubSpot, Facebook, and Outlook ) enabling teams to link financial data, invoices, or expense reports directly to Trello cards.

Visual Overview & Reporting:

Trello’s visual interface provides an at-a-glance overview of project progress, which can be adapted for financial project tracking.

Pros:

- Organizes tasks effectively.

- User-friendly for small teams.

- Efficient task assignment.

- Links with various apps for added functionality.

Cons:

- Lacks comprehensive accounting tools.

- May struggle with complex accounting for larger businesses.

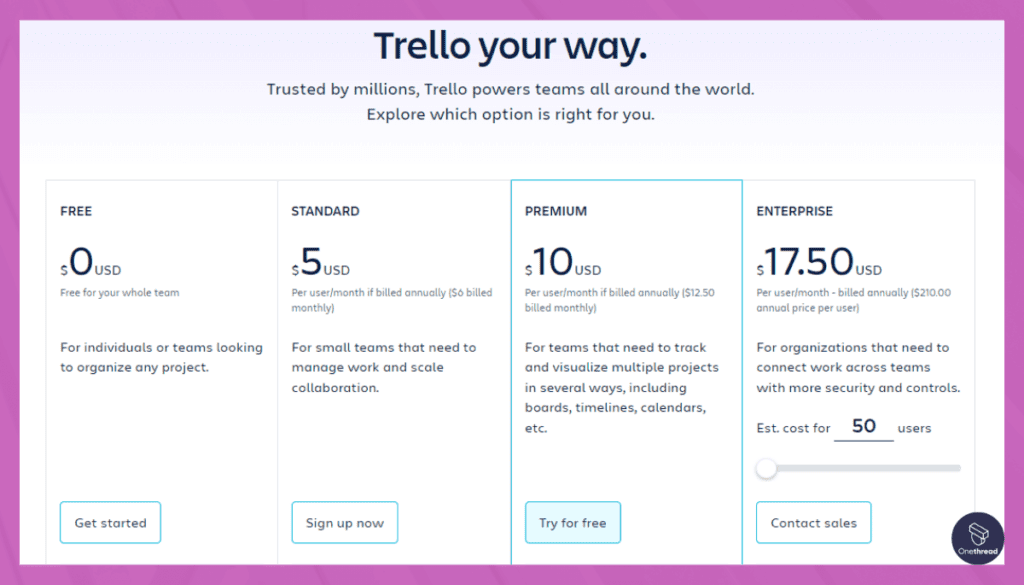

Pricing

- Free: $0

- Standard: $5/user/month

- Premium: $10/user/month

- Enterprise: $17.5/user/month

What Users Say About Trello?

Product Hunt Review: 4.8/5

Positive Review

I really liked it when we used Trello, really smooth and user-friendly. Much more user-friendly than Jira. Orosz Tibi

G2 Review: 4.2/5

Critical Review

I am expecting a better interface for Trello. Verified User in Information Technology and Service

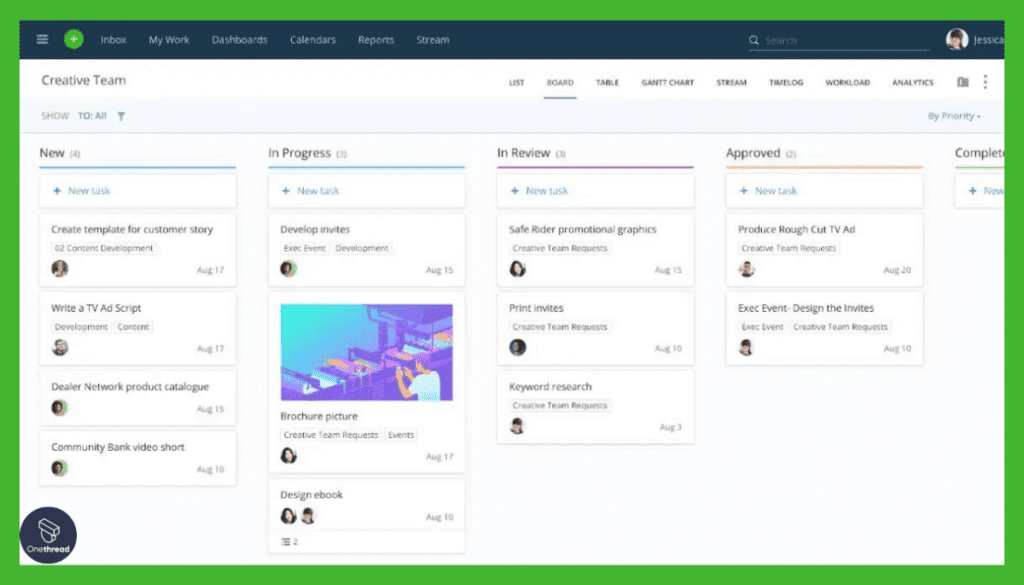

7. ClickUp

Adaptable workflow platform.

ClickUp stands out as a comprehensive accounting software for project management, offering essential features crucial for streamlined operations.

It excels in pivotal areas like robust workflow management with customizable workflows, collaborative tools fostering efficient team communication, comprehensive reporting functionalities, and seamless data fusion with financial software.

In our rigorous testing, ClickUp showcased exceptional adaptability, accommodating diverse business needs while ensuring precise insights through unified project and financial data. Its intuitive interface enhances user experience, empowering teams to manage accounting-related tasks seamlessly.

However, users may encounter a learning curve due to its extensive functionalities. ClickUp’s versatility and integrated approach make it a top choice for proficiently managing accounting tasks within project frameworks.

Features

ClickUp stands out with these features:

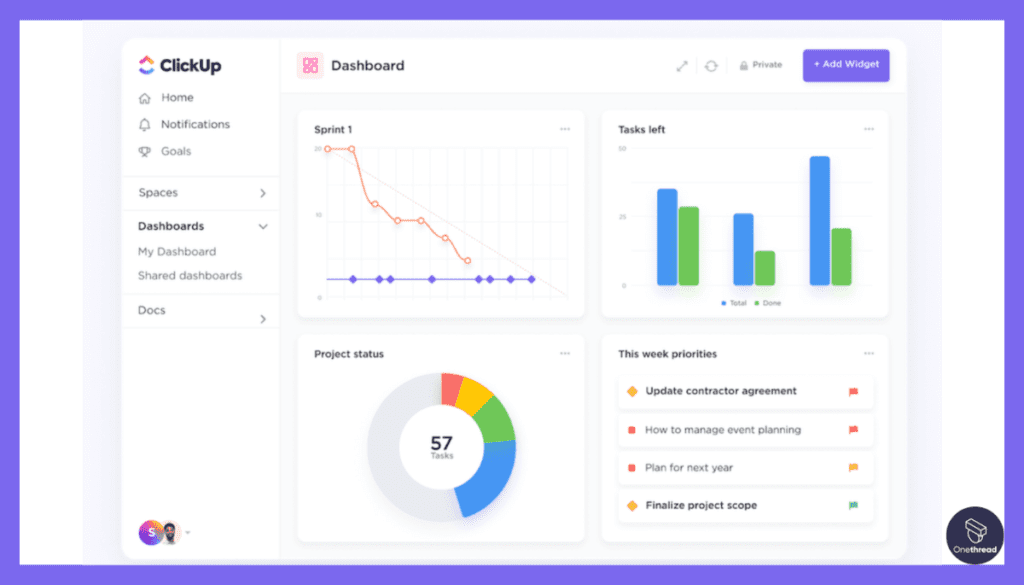

Customizable Dashboards:

ClickUp offers tailored dashboards for financial tracking, integrating accounting data within project workflow management views for enhanced oversight of expenses, budgets, and revenue.

Time Tracking & Budget Management:

It provides robust time tracking tools coupled with budget allocation features, enabling precise financial monitoring and adherence to project budgets.

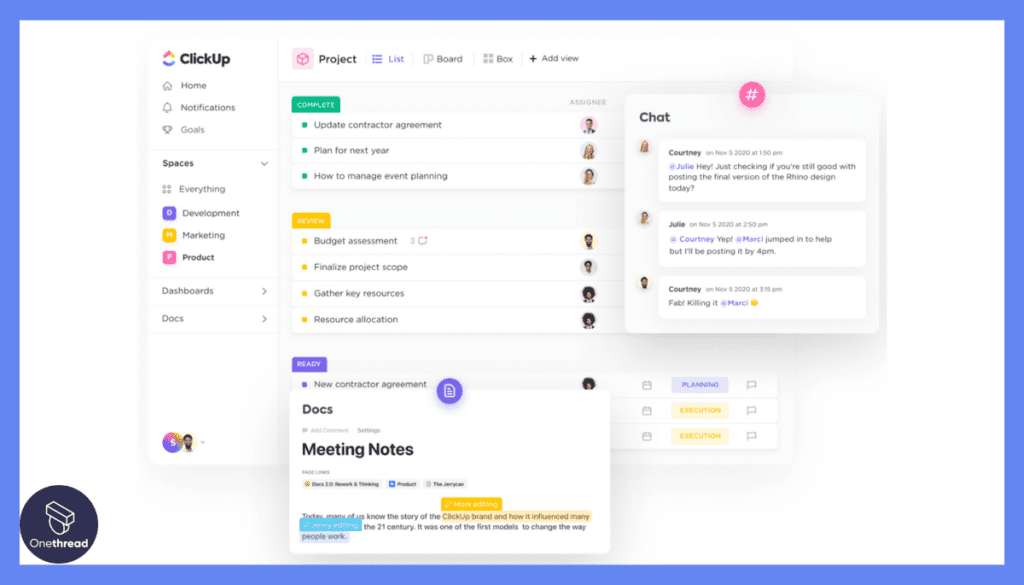

Task Automation:

ClickUp automates repetitive accounting tasks, streamlining processes like invoice generation and expense categorization for efficient accounting management.

Collaborative Workspace:

Its collaborative environment fosters team communication and file sharing, centralizing accounting-related discussions and documentation for improved efficiency.

Pros:

- Comprehensive for project and simple work management in accounting workflows.

- Adaptable features for specific accounting needs.

- Facilitates seamless team communication.

- Links with various apps, enhancing functionality.

Cons:

- Might overwhelm new users.

- Requires time to grasp its full potential.

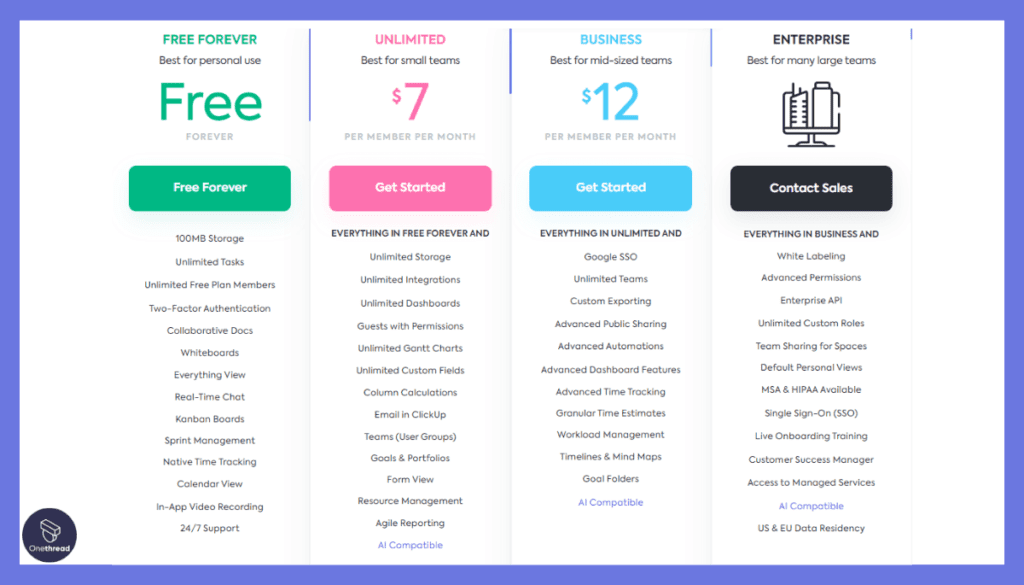

Pricing

- Free: $0

- Unlimited: $7/user/month

- Business: $12/user/month

- Enterprise: Custom

What Users Say About ClickUp?

Product Hunt Review: 4.5/5

Positive Review

a true all-in-one app for all of my company’s needs. I highly recommend the enterprise plan. Abdulrahman Jami

G2 Review: 4.7/5

Critical Review

On my computer, I have to refresh the page or click on another person in the group to update my tasks. I leave it up on my computer all week so it makes me refresh it often. If someone adds a task that day then it’s likely I won’t see it on time. I make alerts to remind me to refresh it daily. Dr. Hillary H.

8. FreshBooks

User-friendly accounting assistant.

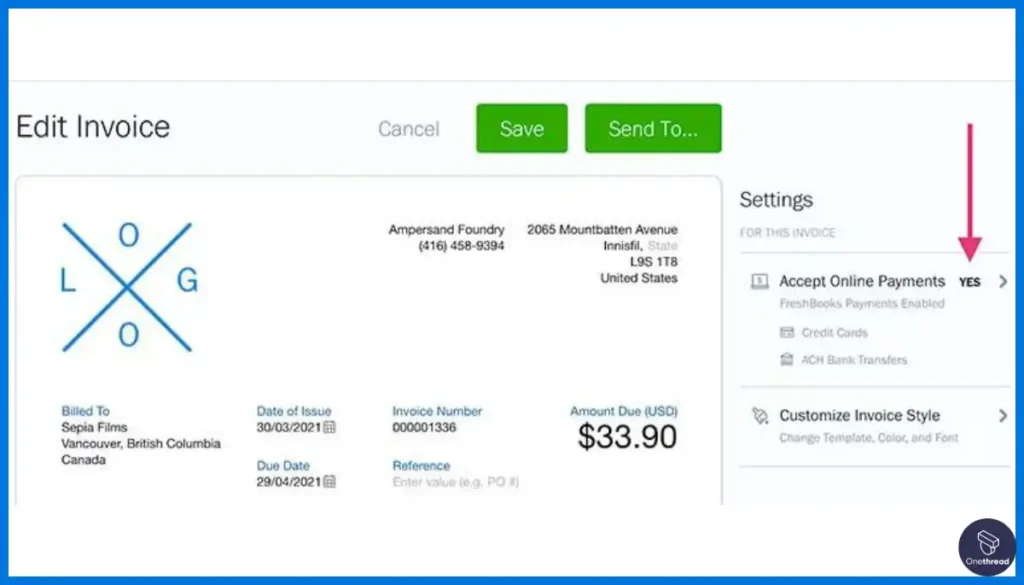

FreshBooks is a reliable accounting software that seamlessly integrates with project management, making it a top choice for businesses.

It simplifies financial tasks like invoicing, expense tracking, and financial reporting, ensuring accuracy and efficiency.

FreshBooks’ user-friendly features enable easy linking of projects to expenses, allowing for effective project cost management. Its intuitive interface and real-time data access make it a credible solution for businesses seeking streamlined project accounting.

Whether you’re an individual or a larger enterprise, FreshBooks is a trusted tool that helps you stay on top of your finances while focusing on project performance.

Features

Simplified Accounting:

You can track expenses, generate invoices, and even prepare for tax season, all within the same platform.

Faster Invoicing:

The software allows you to create and send invoices quickly. This is crucial for everyone who needs to bill multiple clients and wants to get paid faster. The faster you invoice, the faster you get paid.

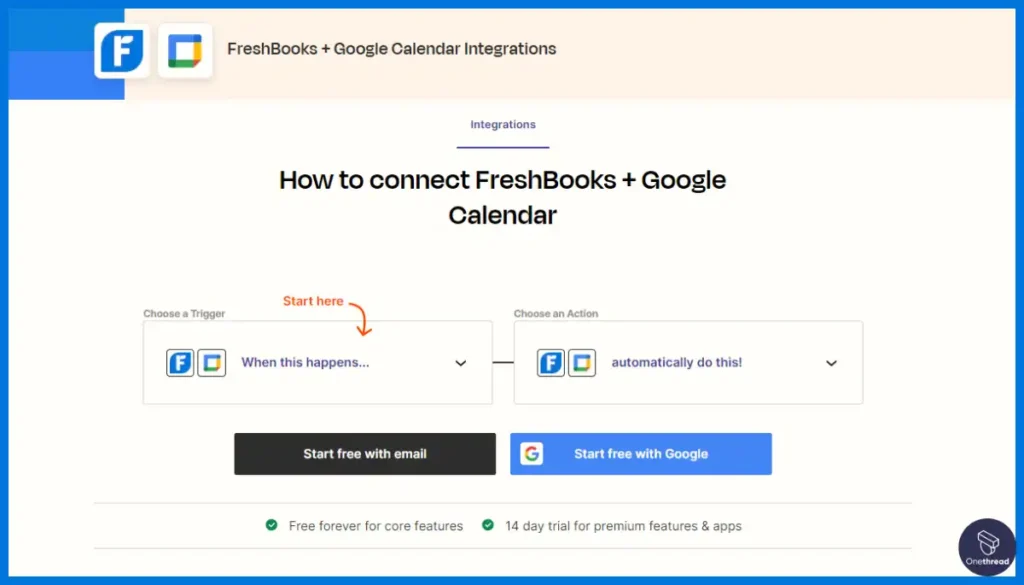

Google Calendar Integration:

FreshBooks integrates with Google Calendar to accurately track meetings and maximize profits.

Inventory Tracking:

FreshBooks offers inventory tracking features, allowing you to manage your resources effectively. This is particularly useful for everyone who deals with physical goods in addition to services.

Bank Transfer (ACH Payment):

Setting up a bank transfer is easy with FreshBooks. This is a secure and efficient way to receive payments, which is essential for everyone who needs a reliable cash flow.

Pros:

- User-friendly interface

- Quick invoicing features

- Google Calendar data fusion

- Secure payment options

Cons:

- Limited third-party data fusions

- May be expensive for some

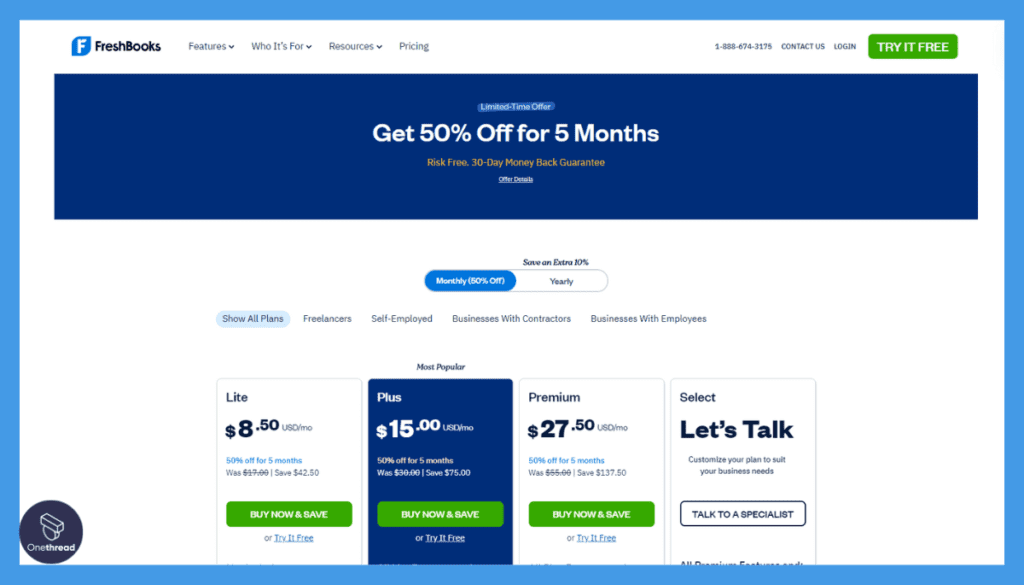

Pricing Plans

- Lite: ($4.25/Month)

- Plus: ($7.50/Month)

- Premium: ($13.75/Month)

- Select: Custom

What Users Say About FreshBooks?

Product Hunt Review: 5/5

Positive Review

It’s number one but have to think about the price and give more flexibility of branding design invoices or other things it will be more better future please start this. Ribier Design

G2 Review: 4.5/5

Critical Review

I mistakenly put in the wrong name on a credit card entry payment and the system initially accepted it and then denied it. They placed a one-week hold so I could not re-submit and receive payment on a large invoice. It was so frustrating that Freshbooks doesn’t have better business practices concerning this since small businesses are their primary audience. Wanda. S.

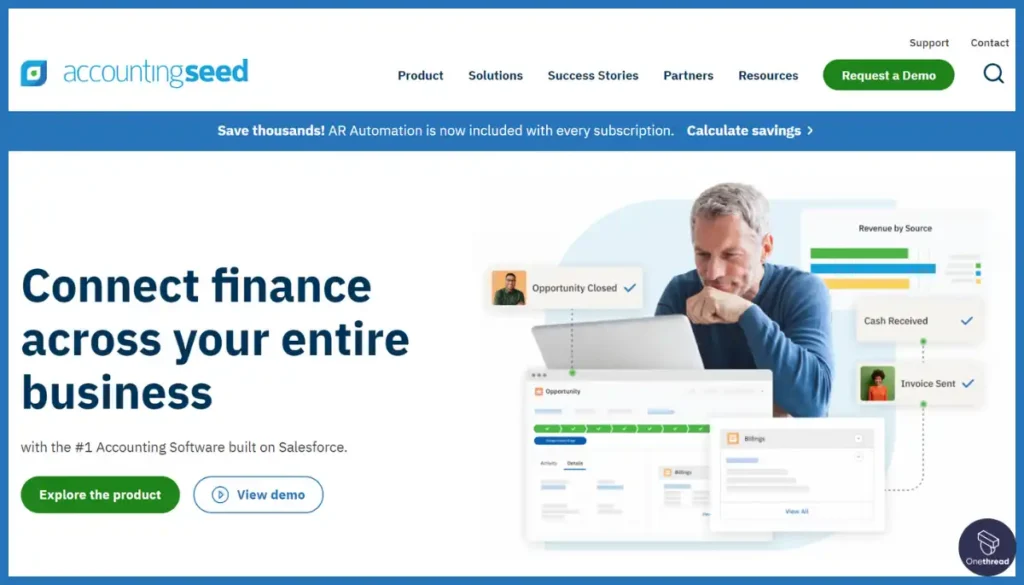

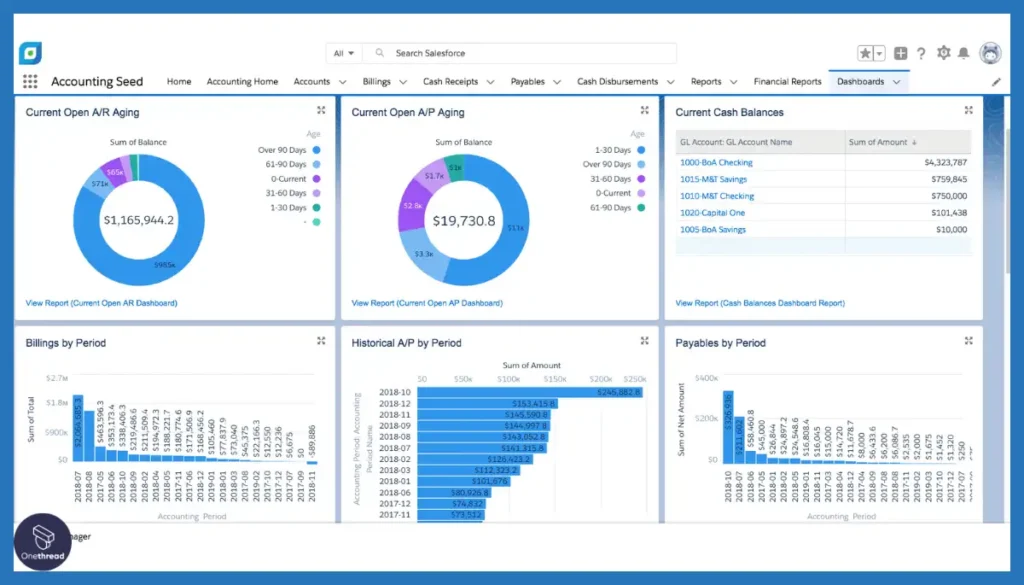

9. Accounting Seed

Modern financial platform built on Salesforce.

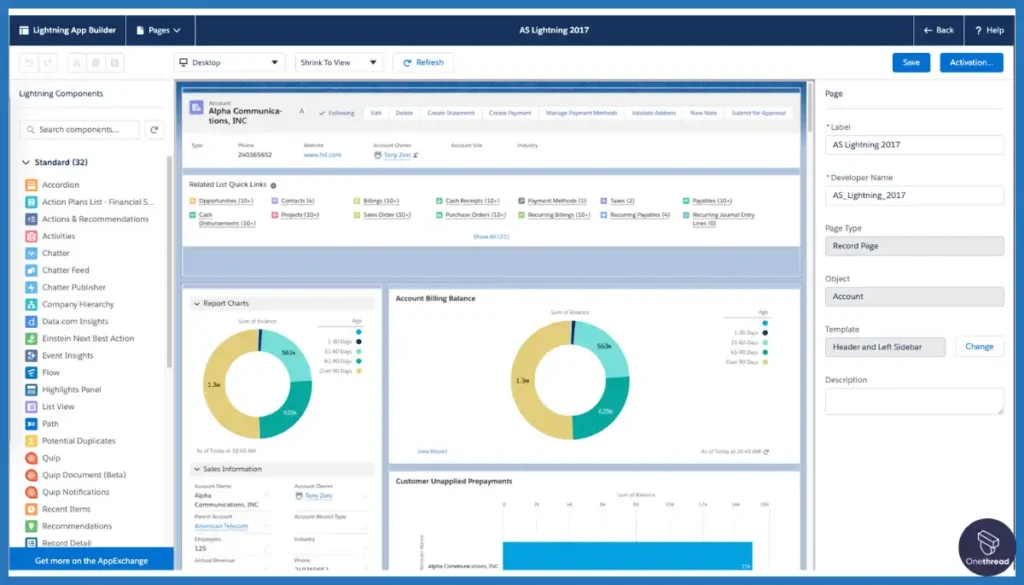

Accounting Seed is an exceptional financial software for project management, providing essential features crucial for streamlined financial tracking.

During our comprehensive testing by the review team, Accounting Seed demonstrated robust capabilities in budget tracking, customizable reporting, real-time financial insights, and seamless data fusion, all pivotal for effective project accounting. Its adaptability across industries and scalability stood out, enabling tailored financial management within projects.

However, compared to FreshBooks, Accounting Seed might pose challenges for beginners due to its complexity in setting up intricate financial workflows.

Also, some users might find its interface less intuitive, impacting usability for complex accounting tasks. Despite these nuances, Accounting Seed remains a powerful tool for comprehensive project financial management.

Key Features

Customizable Reports:

Accounting Seed allows you to create customizable reports tailored to your needs. You no longer have to export data to Excel and spend hours reformatting.

Seamless Connection to Salesforce:

The software offers a seamless data fusion with Salesforce, making the user interface fast and efficient.

Packed with Automation:

From billing to payment processing, Accounting Seed automates various tasks. This significantly shortens the time to cash, a crucial factor for everyone who needs to maintain a healthy cash flow.

Native Solution Over Standalone Software:

Being a native solution, Accounting Seed offers benefits over standalone software. It eliminates the need for costly data fusions and keeps all your data in one place, making it easier to manage projects.

Pros:

- Highly customizable

- Seamless Salesforce integration

- Robust automation features

- Positive user testimonials

Cons:

- May require a learning curve

- Could be expensive for some individuals

Pricing Plans

The pricing plans for Accounting Seed are not publicly disclosed. You’ll need to contact the company for a customized quote based on your needs.

What Users Say About Accounting Seed?

G2 Review: 4.1/5

Positive Review

The system is very user-friendly and lays out the specific transactions in a way that is easy to interpret and understand. Willie C.

Critical Review

That you have to log in to their support portal now to submit support cases and I don’t get email replies when they reply so I have to log in to see what they said. They built their support portal using Lightning Community and it’s not very good. Sam B.

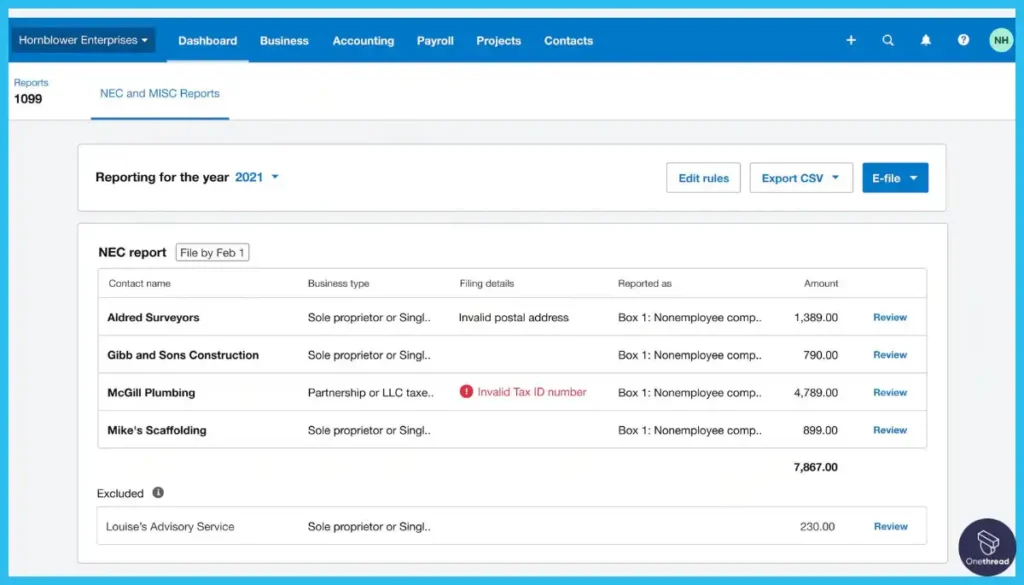

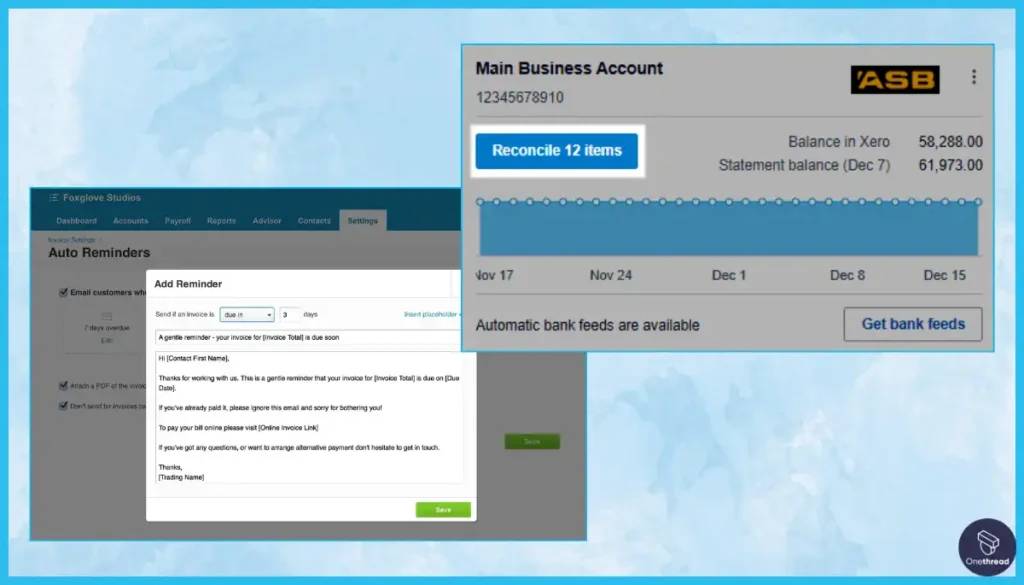

10. Xero

Affordable accounting suite for solopreneurs.

Xero is a reputable accounting software tailored for effective project management. It’s user-friendly and ideal for businesses of all sizes. With Xero, you can effortlessly manage finances while keeping your projects on track.

This software simplifies tasks like invoicing, expense tracking, and financial reporting, ensuring accuracy and efficiency.

Xero’s seamless data fusion with project management tools allows you to link expenses to specific projects, making cost monitoring a breeze.

Its intuitive interface and real-time data access make it a credible choice for businesses seeking streamlined project accounting. Xero is a reliable and easy-to-use solution that keeps your finances in order while you focus on your projects. Let’s explore its features, pros and cons, pricing, and customer ratings.

Features

Paperless Record Keeping:

Xero centralizes your finances in a secure cloud environment. You can keep track of all your financial records without the hassle of paper documents.

Smart Data and Insights:

Xero provides trend analysis and customizable reporting. Make informed business decisions based on real data.

Industry-Specific Solutions:

Whether you’re in construction, real estate, or retail, Xero offers industry-specific solutions. This makes it versatile and suitable for everyone across various sectors.

Automated Features:

From reconciling bank transactions to sending invoice reminders, Xero automates many tasks. This saves you time and allows you to focus on your projects.

Pros:

- User-friendly interface

- Robust automation features

- Secure cloud-based system

- 24/7 customer support

Cons:

- Can be pricey for some individuals

- Limited third-party data fusions

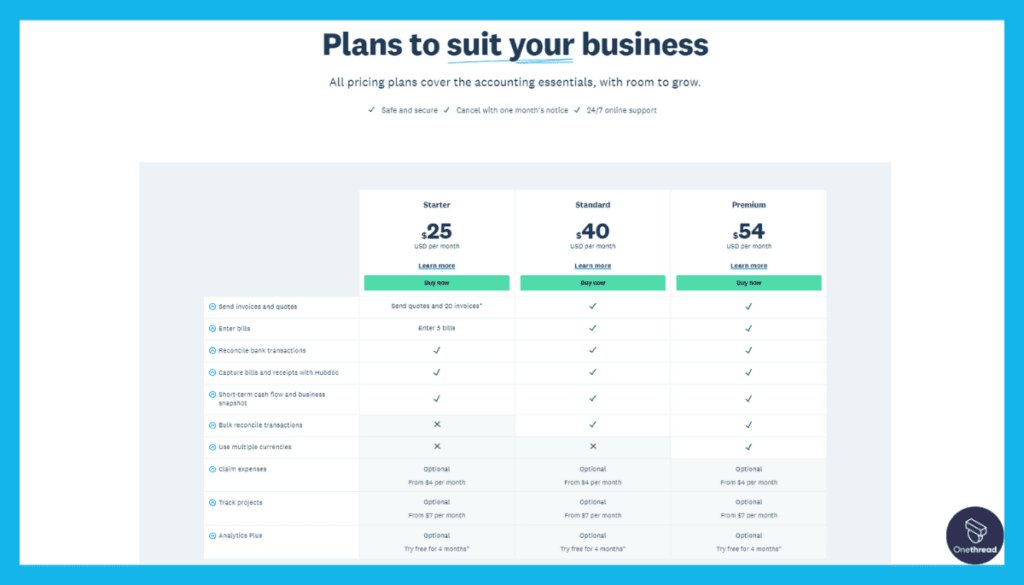

Pricing Plans

- Early: $7.5 USD per month

- Good for sole traders and new businesses

- Growing: $21.00 USD per month

- Suitable for growing small businesses

- Established: $39 USD per month

- Ideal for established businesses

What Users Say About Xero?

Product Hunt Review: 4.1/5

Positive Review

Have integrated Xero with Ari. It works like a charm. Ari Retail Software

G2 Review: 4.3/5

Critical Review

Xero doesn’t scale well when you need to add multiple cost centers, tracking codes work well for a while, but once you have more than 5-6 cost centers, it gets pretty clunky.

While there is a great community of users, the Xero helpdesk is very slow for more complex issues. Te Ariki P.

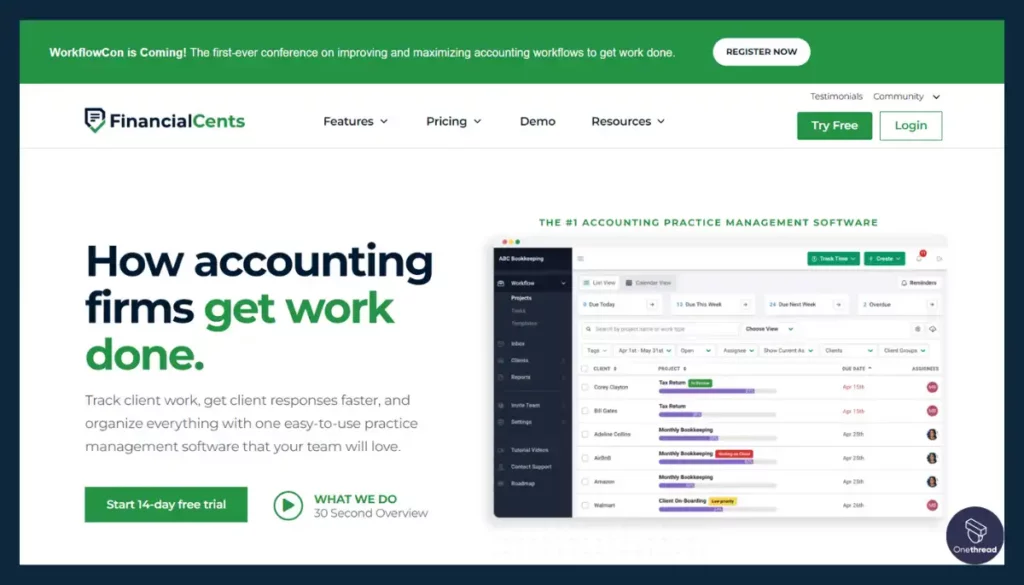

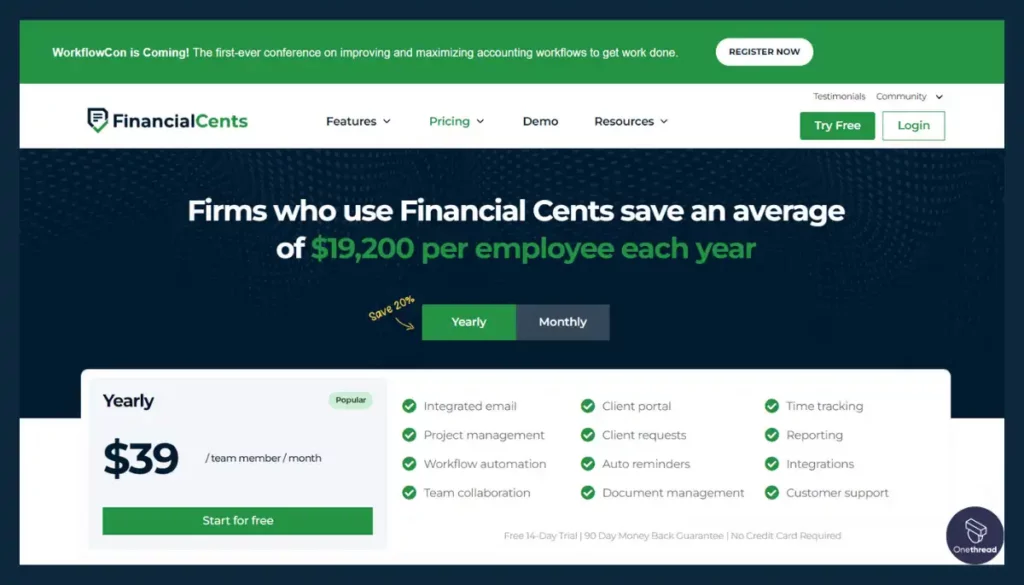

11. Financial Cents

Basic bookkeeping app for non-accountants.

Financial Cents emerges as a robust accounting software for project management, offering pivotal features crucial for streamlined operations. Noteworthy attributes include comprehensive financial tracking, customizable project workflows, real-time collaboration tools, and insightful reporting functionalities.

Financial Cents showcased adeptness in aligning project and financial data, providing accurate insights for resource allocation and budgeting to our review team.

However, when compared to Accounting Seed, Financial Cents exhibits limitations in data fusion flexibility and scalability, hindering seamless workflow transitions and adaptability to evolving project demands.

While effective in core accounting aspects, these constraints might affect its suitability for businesses requiring extensive data fusion capabilities and scalability in project management processes.

Features

Financial Cents, an exemplary financial software for project management, integrates vital features aligned with accounting needs:

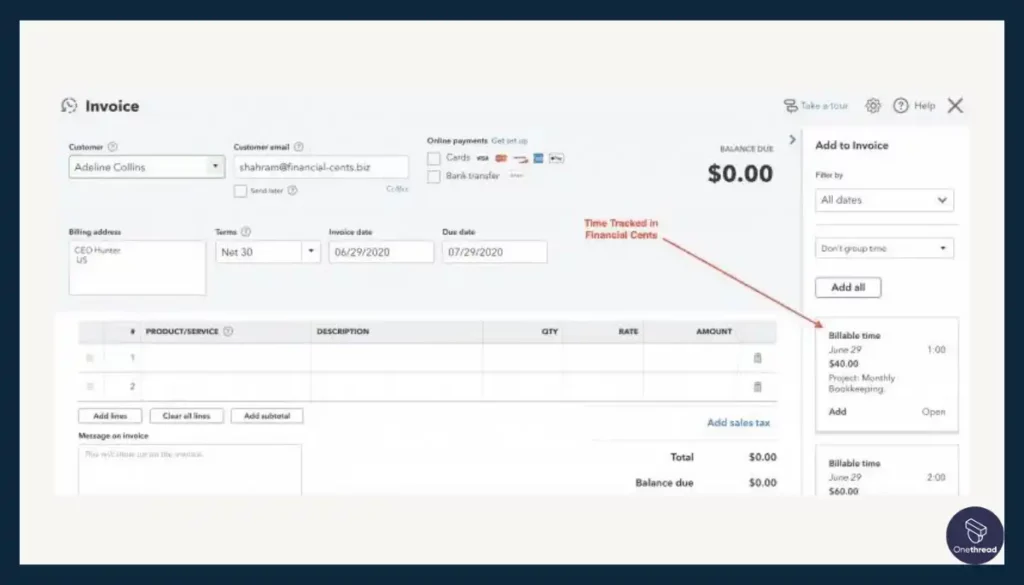

Expense Tracking and Invoicing:

Streamlines expense monitoring and invoicing processes within project frameworks.

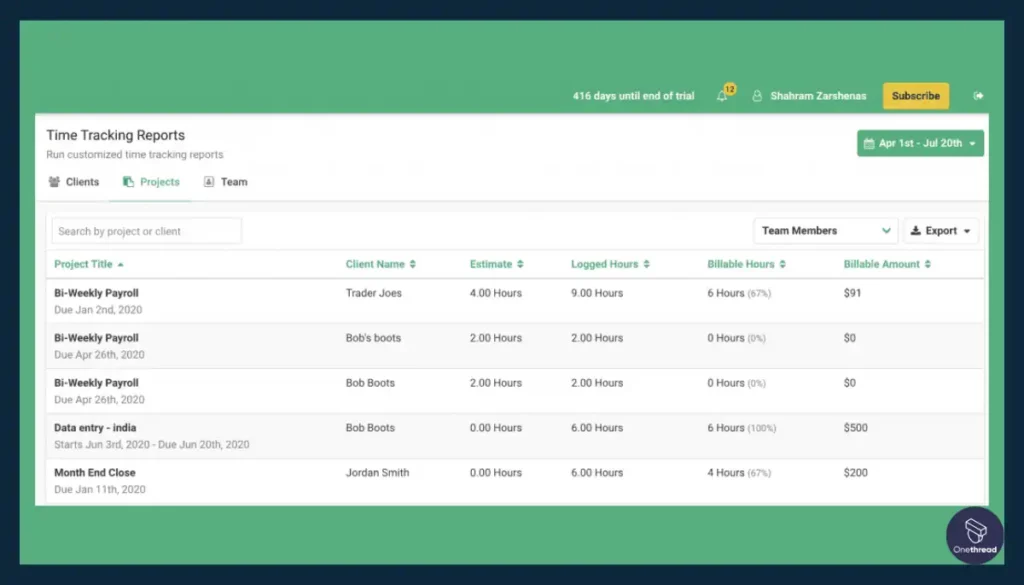

Project-Centric Financial Reporting:

Offers specialized reporting tailored to project finances, aiding in detailed analysis and decision-making.

Time Management Integration:

Integrates time tracking with financial data, enhancing project accounting accuracy.

Resource Allocation Tools:

Facilitates efficient allocation of resources, ensuring optimal financial utilization within projects.

Pros:

- Precise Financial Tracking

- Seamless data fusions

- Real-time Insights

- Customizable Reports

Cons:

- Complex Interface

- Limited Project Tools

- Data fusion Challenges

Pricing

- Team Plan: $39/ month/(per user)/Billed annually

- Scale Plan: $59/ month/(per user)/Billed annually

What Users Say About Financial Cents?

G2 Review: 4.7/5

Positive Review

Financial Cents has been a great time saver and has helped my accounting firm organize and automate document collection from clients which used to be a huge pain.

Highly recommend this to all accounting firms! Vipul J.

Critical Review

They are still early in their development cycle, so may not have all of the bells & whistles that other systems have, but they make up for it with the ease of use. Roman V.

Key Features To Consider While Choosing the Best Accounting Software For Project Management

1. Integration Capabilities

Data fusion is vital for seamless data flow between accounting and project management. Look for software that easily syncs financial data with project tasks, expenses, and timelines, ensuring cohesive operations.

2. Financial Tracking and Reporting

Robust financial tracking tools are essential. The software should provide detailed insights into project expenses, revenue, budgets, and profitability, facilitating informed decision-making.

3. Task and Project Management Tools

Effective task and project management functionalities streamline workflows. Look for tools that enable task assignment, progress tracking, team collaboration, and resource allocation within the accounting context.

4. Customization and Scalability

The ability to customize the software to suit your business needs is crucial. Ensure scalability to accommodate growth, allowing for additional users, features, and enhanced functionalities as your business expands.

5. Security and Compliance

Ensure the software adheres to industry standards for data security and compliance. Look for encryption, access controls, and compliance certifications to safeguard sensitive financial information.

So, What’s The best accounting software for project management?

After extensive research on leading accounting platforms’ project management data fusions, QuickBooks emerges as the top project management software for accountants.

QuickBooks seamlessly syncs expenses, budgets, timesheets, and invoices between its accounting interface and major project tools like Asana, Trello, and monday.com. This consolidates financial oversight alongside workflow coordination.

Exceptional customer service ensures easy setup and quick issue resolution without relying on complex support tickets. Also, QuickBooks offers a 30-day free trial so users can test real-time syncing and reporting before deciding on the best plan for their needs.

For project-driven teams seeking unified finance control, QuickBooks is the premier pick. Xero and NetSuite also provide strong accounting systems worthy of consideration among project managers and organizations.

Our review team emphasized QuickBooks as the top choice for financial software among project management users.

Getting the Most Out of Accounting Software For Project Management

Getting the most out of accounting software for project management is crucial for success. Here’s how to maximize the benefits:

- Choose Wisely: Pick software that aligns with your project needs. Look for features like time-tracking and invoicing.

- Integrate Tools: Sync the accounting software with other project management tools. This creates a seamless workflow.

- User Training: Train your team. Make sure everyone knows how to use the software effectively.

- Regular Updates: Keep the software up-to-date. New features and security patches are important.

- Data Backup: Always back up your data. You don’t want to lose important financial information.

- Review Reports: Use built-in analytics. Review financial reports to track project health.

- Set Budgets: Use the software to set and monitor budgets. This keeps the project on track financially.

By following these best practices, you’ll get the most out of your accounting software for project management.

FAQs

How does project management software enhance collaboration between accounting professionals?

Accounting management tools enhanced collaboration by allowing real-time updates, file sharing, and task assignment, fostering efficient teamwork among accountants.

Can project management software integrate seamlessly with accounting software and tools?

Accounting management tool offers seamless integration with accounting tools, streamlining data transfer and workflow.

What security measures should project management software for accounting tasks have in place?

Accounting management tools’ robust encryption, user authentication, and restricted access to sensitive financial data ensure software security.

What benefits can a company expect by implementing project management software in their accounting department?

Accounting management tools Improved efficiency, streamlined processes, accurate financial tracking, better resource allocation, and enhanced communication lead to increased productivity and streamlined accounting operations.

Summary

Accounting software for project management is a vital tool for any business. It streamlines financial tracking, enhances team collaboration, and helps meet project goals.

However, its effectiveness lies in proper usage. By training your team and integrating it with other tools, you can maximize its benefits. Choose wisely and make data-driven decisions to ensure project success.