Numbers, budgets, and financial forecasts are the lifeblood of any business. According to a recent report, companies that transitioned to cloud accounting witnessed a 15% increase in their revenue. In the ever-evolving world of business where profitability is a key end goal, this statistic underscores the urgent need for powerful Accounting Project Management Software.

Welcome to the realm where numbers meet project management, where data-driven decisions take center stage. In this article, we’re about to unveil the top 5 Accounting Project Management Software solutions that are set to revolutionize how you handle financial tasks and projects.

Whether you’re an accountant, a financial analyst, or a business owner, these tools are your ticket to a more organized, efficient, and accurate financial world. Join us as we explore the software that can turn your accounting projects into smooth, well-orchestrated symphonies of success.

Quick List of 5 Accounting Project Management Software

- Proprofs: Ideal for Accounts, combining invoicing, expense tracking, and project management in one platform.

- QuickBooks Online: A well-known tool for small businesses, offering seamless accounting and project tracking.

- Xero: A cloud-based solution that integrates accounting with third-party project management apps.

- Microsoft Project: Targets larger businesses and offers advanced financial management features along with project accounting.

- Financial Cents: Budget-friendly and easy-to-use, with a focus on simplicity and real-time collaboration.

Our reviewers evaluate software independently. Clicks may earn a commission, which supports testing. Learn how we stay transparent & our review methodology

Comparison Chart Of Accounting Project Management Software

Here is the comparison of Accounting Project Management Software,

Software / Features | Invoicing | Time Tracking | Expense Management | Integration |

| Clear and concise overview of all financial transactions, Chat tick Generate instant client invoices. | Track time or billable hours on projects & tasks. | tracking expenses, estimating project expenses | Mailchimp · Salesforce · WordPress Quiz · SCORM |

| Advanced invoicing options | Basic time tracking | Basic expense tracking | Broad app integration |

| Invoicing and billing | Time tracking capabilities | Expense tracking | Extensive third-party apps |

| Limited invoicing | Time tracking features | Limited expense tracking | Limited integrations |

| Invoicing and billing | Time tracking capabilities | Expense tracking | Integrations available |

What is Accounting Project Management Software?

Accounting Project Management Software is a specialized digital tool designed to streamline and enhance the management of financial tasks and projects within a business. Imagine Accounting Project Management Software as a versatile Swiss Army knife for financial professionals.

Just as the Swiss Army knife equips you with everything from a blade to a corkscrew, the software equips financial teams with the ability to handle accounting tasks, track project progress, manage budgets, generate invoices, and collaborate seamlessly within one unified platform.

It’s like having a handy tool that fits in your pocket, ready to tackle the complexities of financial management and project coordination efficiently and easily.

How Accounting Project Management Software Can Help Your Business?

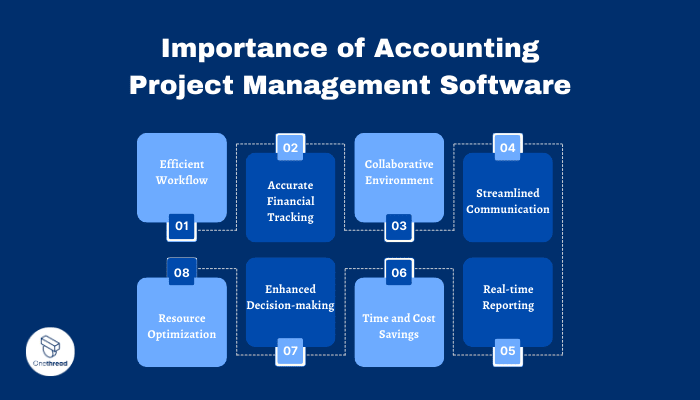

Accounting Project Management Software offers a range of benefits that can significantly enhance your business operations. Here’s how it can help:

- Efficient Workflow: Seamlessly integrate accounting tasks and project management, saving time and reducing manual errors.

- Accurate Financial Tracking: Monitor budgets, expenses, and invoices in real time for better financial control.

- Collaborative Environment: Foster teamwork by allowing teams to collaborate, share files, and communicate effectively.

- Streamlined Communication: Ensure clear communication between accounting and project teams for smoother coordination.

- Resource Optimization: Allocate resources effectively based on project needs and financial constraints.

- Enhanced Decision-making: Access accurate financial data for informed decision-making and strategic planning.

- Time and Cost Savings: Automate repetitive tasks, leading to increased efficiency and reduced operational costs.

- Real-time Reporting: Generate instant financial reports for stakeholders, improving transparency and accountability.

Incorporating Accounting Project Management Software can revolutionize your business by simplifying processes, improving accuracy, and promoting team collaboration.

While exploring these tools, it’s crucial to have a comprehensive overview of financial statements and their core components.

Key Features to Consider in Accounting Project Management Software

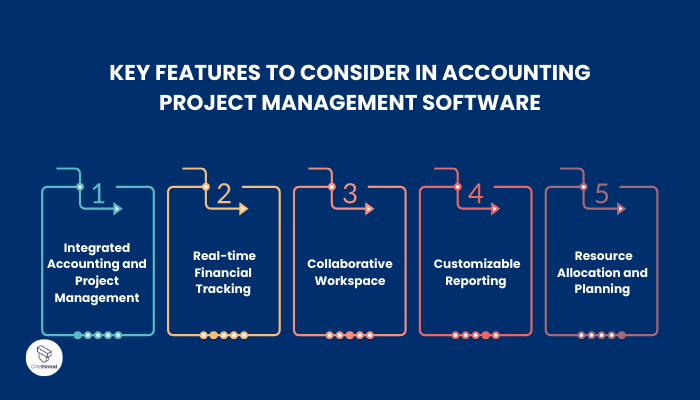

When choosing Accounting Project Management Software, it’s essential to focus on critical features that can elevate your financial management and project coordination. Here, we delve into five crucial features that can significantly streamline your workflow and maximize efficiency.

- Integrated Accounting and Project Management: Combine accounting and project management tools for unified functionality, eliminating tool-switching.

- Real-time Financial Tracking: Track financial data in real-time to make informed decisions, identify discrepancies early, and keep projects financially on track.

- Collaborative Workspace: Enable seamless collaboration between accounting and project management teams, fostering clear communication and reducing miscommunication.

- Customizable Reporting: Tailor reports to your business needs, creating financial statements, project summaries, and performance analytics based on specific parameters.

- Resource Allocation and Planning: Efficiently allocate resources, assign tasks based on team availability and skill sets, and optimize resource usage for smoother project execution and accurate financial forecasts.

Top 5 Accounting Project Management Software

These software options, from integrated solutions to real-time tracking, are designed to enhance your workflow and propel your business forward. Let’s dive into the world of efficiency and collaboration with the best tools in the market.

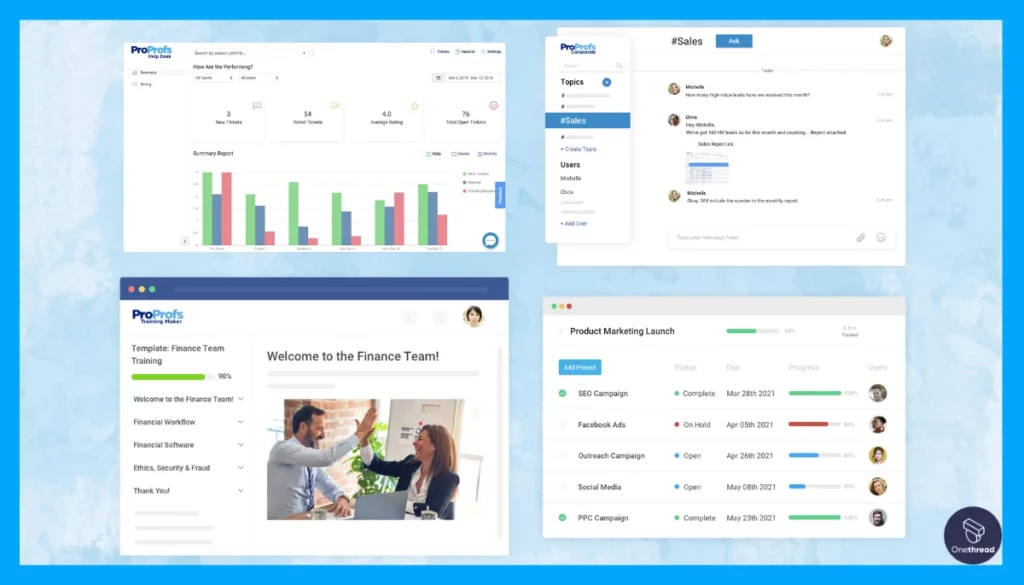

#1. Proprofs

ProProfs is your trusted partner for efficient accounting project management. It simplifies the complex world of financial management with its user-friendly interface. ProProfs offers robust features for tracking expenses, managing budgets, and ensuring compliance.

It’s a go-to choice for accountants and financial professionals. With ProProfs, you can collaborate seamlessly and access your data from anywhere. No more cumbersome spreadsheets or paperwork.

ProProfs streamlines accounting project management, making it easy to read and credible. Trust ProProfs to simplify your financial tasks and keep your projects on track in the realm of accounting.

Proprofs Overview

- Employee Numbers: ProProfs has 145 employees.

- Founding Team: Founded by entrepreneur couple Malini and Sameer Bhatia

Features

Time Tracking

Proprofs comes with a time-tracking feature that is invaluable for accounting. You can log hours spent on different tasks and projects. This helps in accurate billing and assessing your team’s productivity.

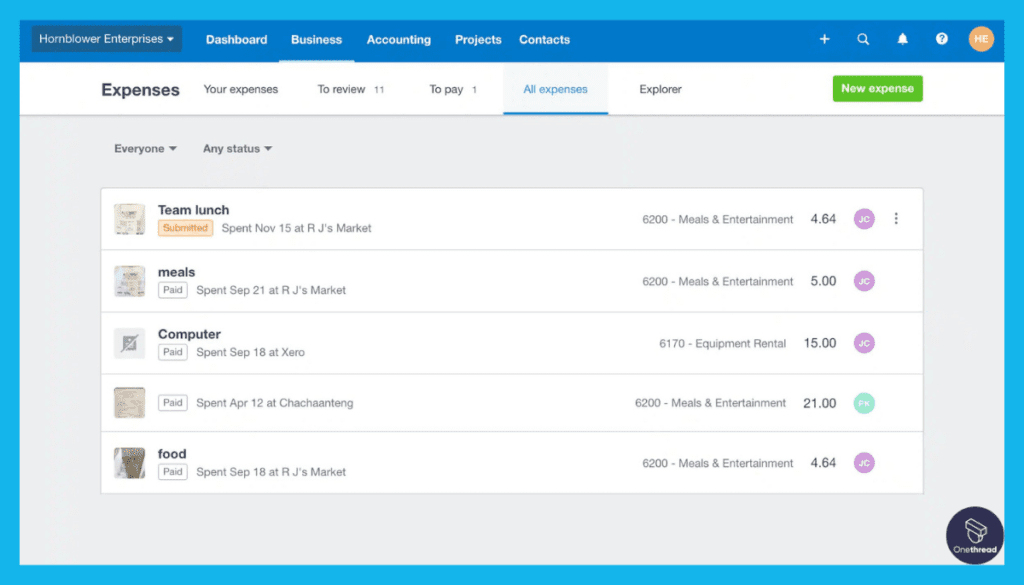

Expense Management

The software offers an expense management feature. You can track all your expenses, categorize them, and even attach receipts. This is crucial for maintaining a clear financial picture and for tax purposes.

Invoicing and Payments

Proprofs allows you to create and send invoices directly from the platform. It supports multiple payment gateways, making it easier for clients to make payments. This streamlines the invoicing and payment process, saving you time and effort.

Collaboration Tools

The platform offers various collaboration tools. Team members can share files, discuss tasks, and update statuses. This is particularly useful for freelancers who may be part of a virtual team and must stay in sync with other members.

Customizable Templates

Proprofs offers customizable templates for invoices, reports, and other accounting documents. This allows you to maintain a consistent and professional look across all your business documents.

Pros & Cons

Pros:

- Comprehensive time-tracking features

- Robust expense management

- Streamlined invoicing and payment process

- Effective collaboration tools

- Customizable templates

Cons:

- May have a learning curve for non-accountants

- Limited third-party integrations

- Can get expensive with add-ons

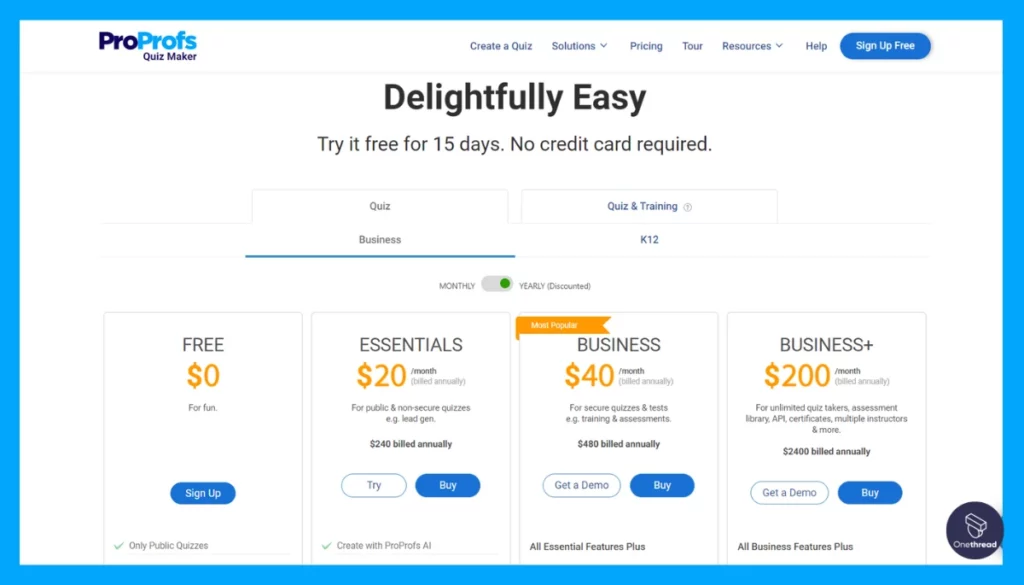

Pricing Plans

- Annual Plan: Starts at $39.97/Year

Customer Ratings

- G2: 4.0 out of 5 stars

- Capterra: 4.1 out of 5 stars

Review

On the positive side, we appreciate its user-friendly interface, making creating quizzes, surveys, and training materials easy. The extensive library of pre-made templates is a time-saver. It’s great for employee training and customer support.

However, there are some downsides. The pricing can become steep as you add more features and users. The reporting and analytics could be more robust. Customer support, while generally responsive, could be quicker at times.

ProProfs is a solid tool for creating educational content and assessments. It’s user-friendly and efficient for training purposes. But consider your budget and the depth of reporting you need, as costs can rise, and analytics might not meet advanced requirements.

Want more options than ProProfs offers? These project management tools provide a diverse selection.

#2. QuickBooks Online

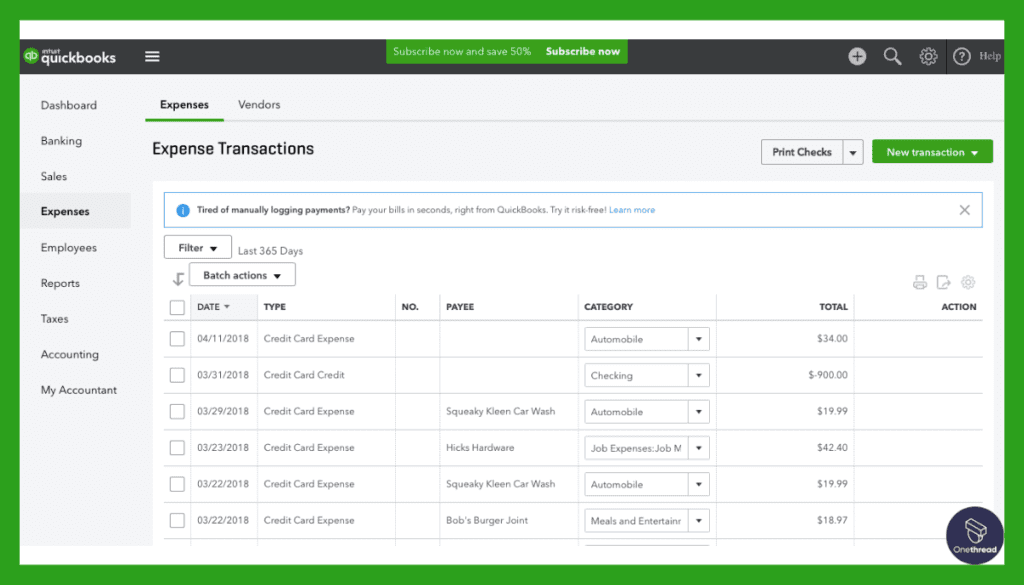

QuickBooks Online, a cloud-based accounting software, is tailored for small businesses and freelancers. It simplifies financial management with bank statement converter, invoicing, expense tracking, and reporting. Integration with bank accounts and credit cards allows easy transaction categorization, cash flow monitoring, and account reconciliation.

Vendor management, sales tax tracking, and financial statement generation are included. Mobile apps provide remote access to business finances. Scalable plans suit various needs, from basic accounting to advanced features like project tracking and inventory management.

QuickBooks Online, with its intuitive interface and comprehensive functionality, streamlines financial processes and aids informed decision-making for businesses.

QuickBooks Online: A Company Snapshot

Company Valuation

- US$17.27 billion (2023)

Employee Numbers

- 18,200 (2023)

Founding Team

- QuickBooks Online is a part of Intuit’s suite of products.

- Intuit was founded by Scott Cook and Tom Proulx, who laid the foundation for QuickBooks Online’s success.

Features

Here are five key features that make it a preferred choice for businesses seeking efficient financial management and project coordination:

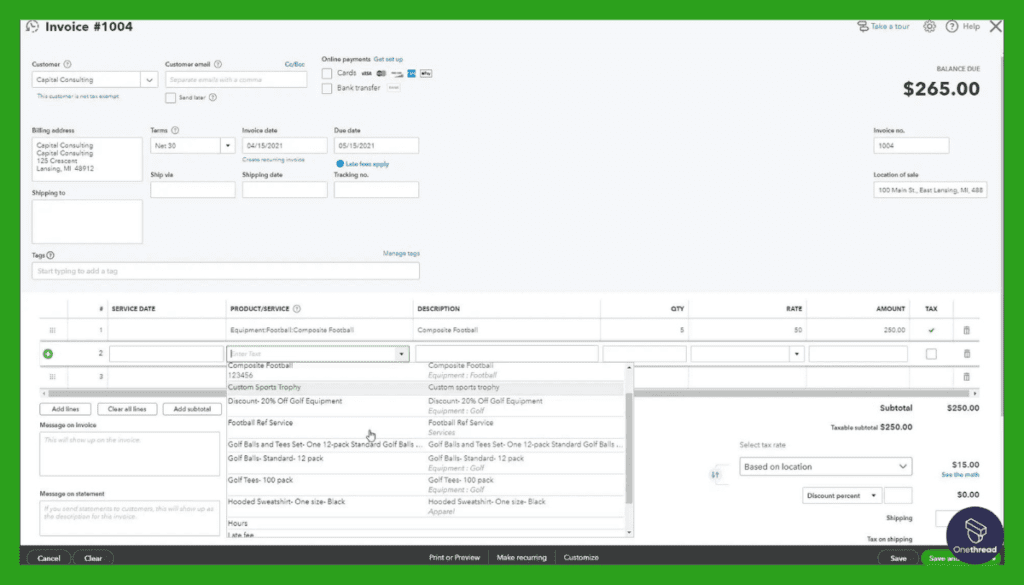

1. Advanced Invoicing Options:

QuickBooks Online takes invoicing to the next level. You can create professional invoices that reflect your brand identity with customizable templates. The software enables automated invoicing, recurring billing, and payment reminders, ensuring timely payments and reducing manual effort.

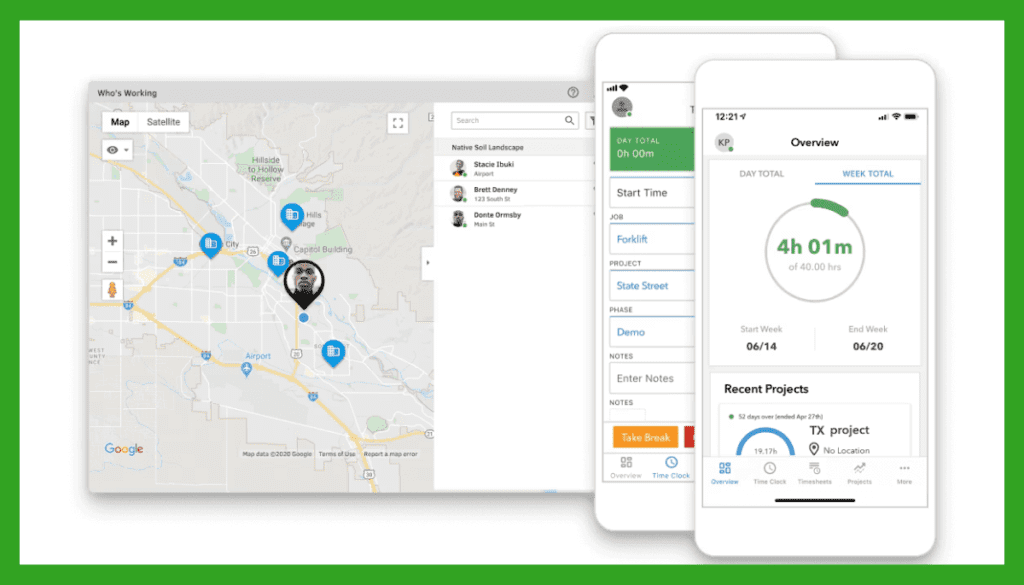

2. Basic Time Tracking:

While primarily known for accounting, QuickBooks Online offers basic time tracking capabilities. You can track billable hours for projects and clients, helping you accurately allocate resources and ensure your projects stay within budget. This functionality is particularly useful for service-based businesses that need to monitor their time investment.

3. Broad App Integration:

QuickBooks Online boasts a wide range of third-party app integrations, enhancing its capabilities beyond accounting. You can seamlessly synchronize project data and financial information by connecting with project management tools like Trello or Asana. This integration streamlines collaboration, ensuring that your team can access project-specific and financial insights.

4. Limited Expense Tracking:

While QuickBooks Online shines in invoicing and income management, its expense tracking capabilities are somewhat limited. While you can track business expenses, the depth of analysis and customization might not match dedicated expense management tools. This limitation is worth considering if detailed expense tracking is a project priority.

5. Basic Project Management:

QuickBooks Online offers basic project management features like task tracking and project categorization. However, these features are not as robust as dedicated project management tools. If your projects heavily rely on complex task dependencies and advanced project planning, you might find the project management functionalities of QuickBooks Online to be somewhat limited.

Pros:

- Advanced invoicing options for professional billing.

- Seamless integration with various third-party apps.

- Basic time tracking functionality for project hours.

- Cloud-based accessibility for remote collaboration.

- Scalable pricing plans for businesses of different sizes.

Cons:

- Limited expense tracking capabilities.

- Basic project management features compared to dedicated tools.

- Integration complexity might require initial setup time.

- Pricing might be relatively higher for small businesses.

- Learning curve for users new to accounting software.

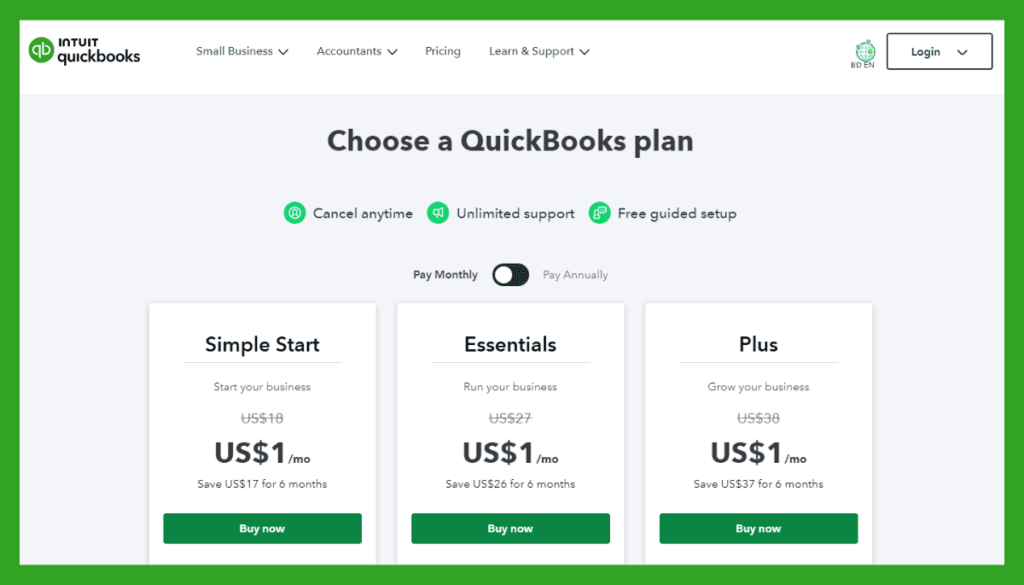

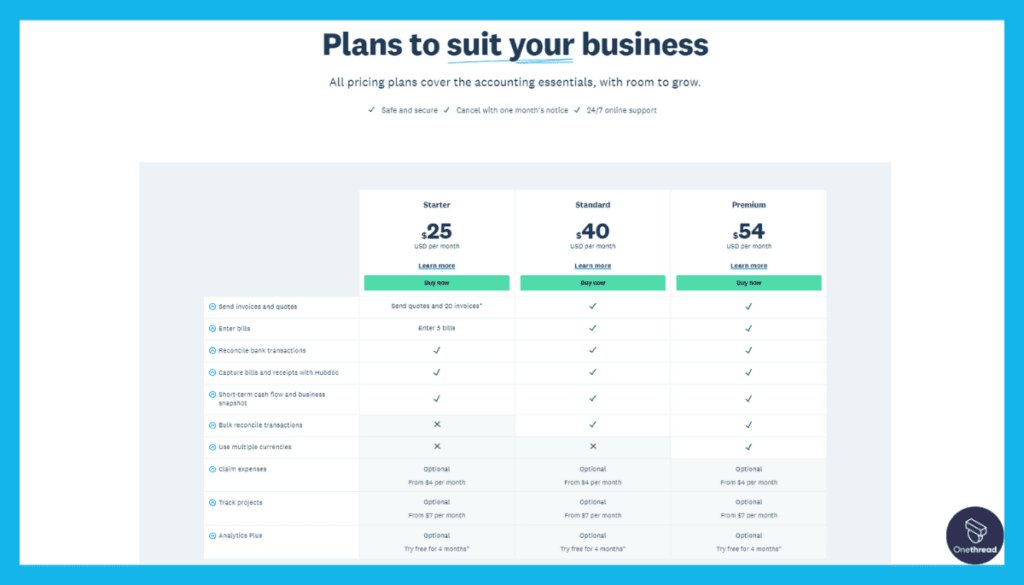

Pricing Plans:

- Simple Start: $25 per month

- Essentials: $40 per month

- Plus: $70 per month

Customer Ratings:

- G2: 4.3/5 based on 11,000+ reviews

- Capterra: 4.3/5 based on 14,000+ reviews

Our Review:

QuickBooks Online excels in streamlining financial tasks with its invoicing capabilities and third-party app integration. While its project management features are basic, its strength lies in its accounting functionalities.

However, businesses seeking advanced project management tools might find their offerings limited. The software’s pricing plans cater to various business sizes, making it a versatile choice for those prioritizing efficient financial management.

Seeking a different project management solution from QuickBooks? Explore these alternatives for variety.

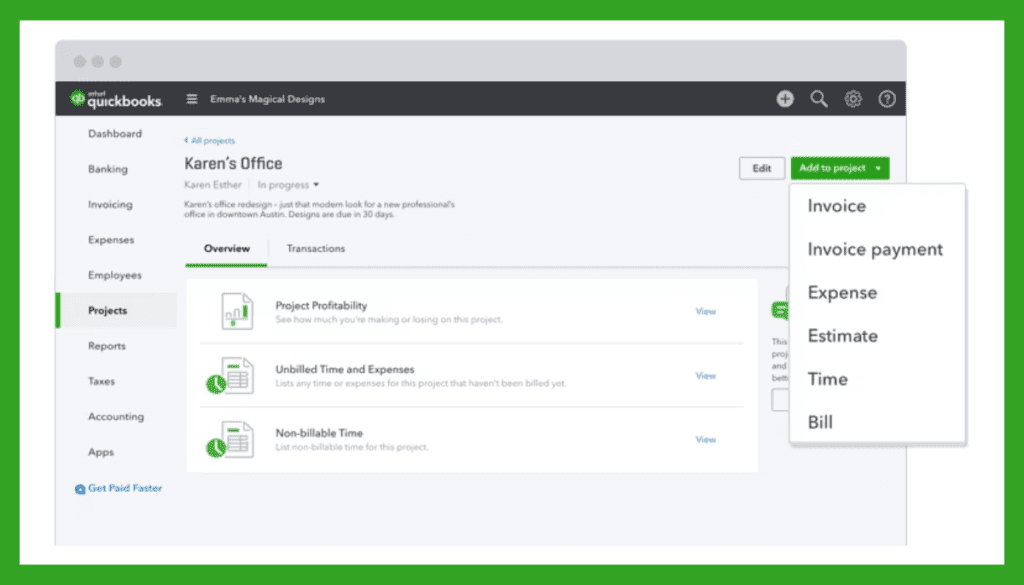

#3. Xero

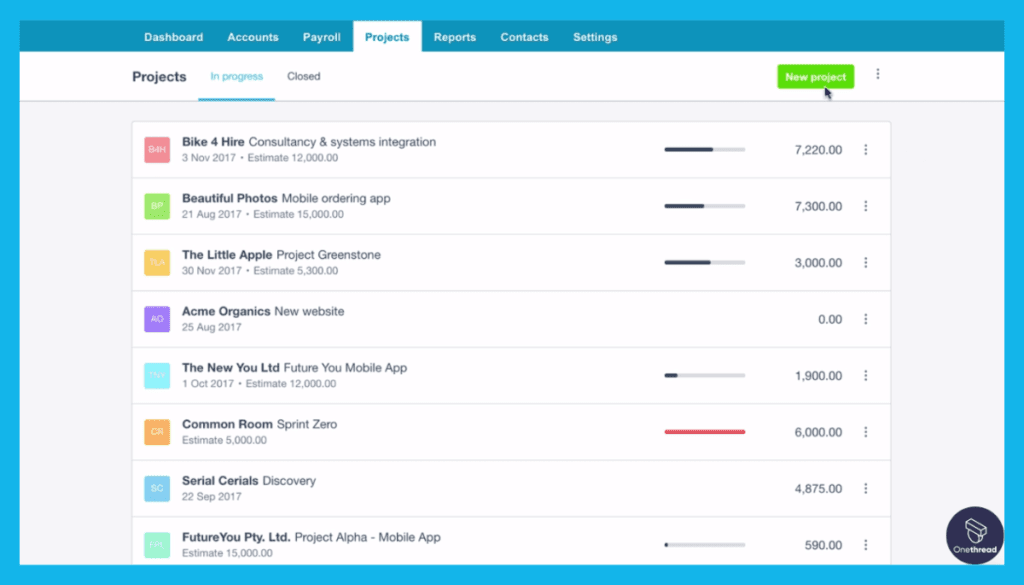

Xero is a cloud-based accounting software that provides small businesses a seamless and efficient way to manage their finances. With its user-friendly interface, Xero offers invoicing, expense tracking, bank reconciliation, and financial reporting features.

It allows businesses to connect their bank accounts and credit cards, automating the process of categorizing transactions and keeping track of cash flow. Xero also offers tools for managing payroll, tracking inventory, and generating financial statements.

The software’s mobile app ensures that users can access their financial information on the go. With its range of plans and add-ons, Xero is suitable for various businesses, from freelancers to larger organizations, helping them stay organized and make informed financial decisions.

Xero: A Company Snapshot

Company Valuation

- NZ$1.053 billion (2023)

Employee Numbers

- 5,080 (2023)

Founding Team

Xero was founded by Rod Drury and Hamish Edwards.

Features

Here are five standout features that position Xero as a top choice for businesses seeking streamlined operations:

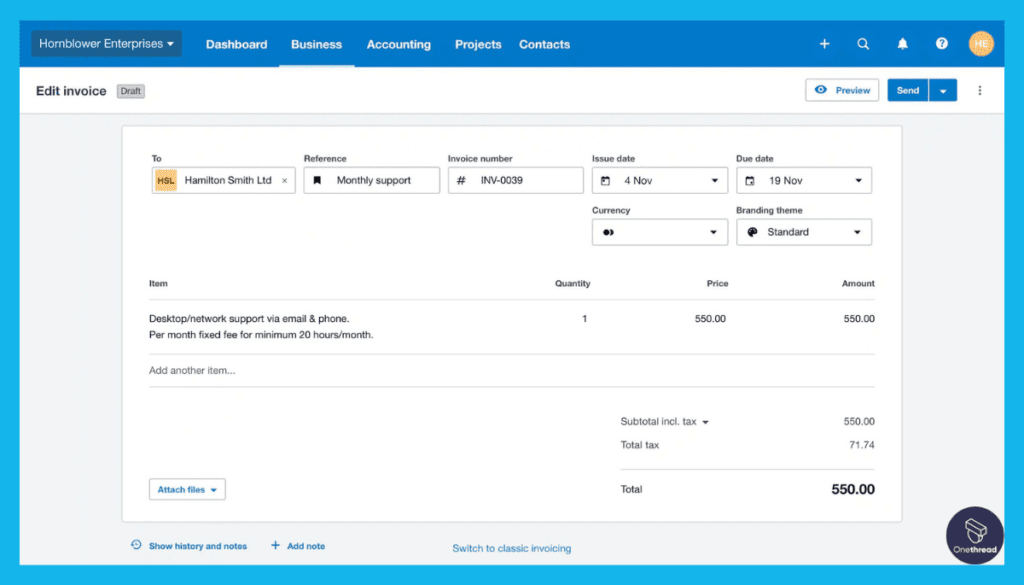

1. Invoicing and Billing Integration:

Xero takes invoicing to the next level by seamlessly integrating it with your financial and project management tasks. Its user-friendly interface allows you to easily create and customize professional invoices, track payments, and even set up recurring billing. This integration ensures that your financial transactions are closely tied to your project progress, providing a holistic view of your business operations.

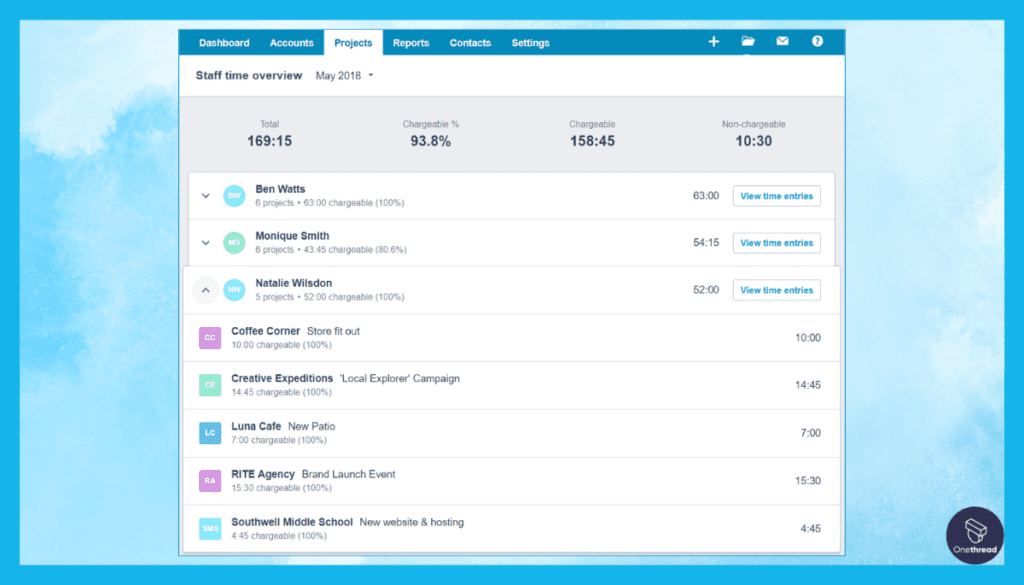

2. Time Tracking Capabilities:

One of Xero’s strengths lies in its robust time-tracking capabilities. With an intuitive dashboard, you can track billable hours, assign tasks, and monitor project timelines. This feature enhances project coordination by allowing you to allocate resources effectively and ensure that projects stay on schedule and within budget.

3. Extensive Third-Party App Integration: Xero’s extensive range of third-party app integrations empowers businesses with enhanced functionalities. You can seamlessly combine project details with financial data by connecting project management tools like Trello or Asana. This integration fosters collaboration and enables your teams to access project-specific information alongside financial insights.

4. Limited Expense Tracking:

While excelling in invoicing and time tracking, Xero’s expense tracking capabilities have limitations. Although you can manage business expenses, the depth of analysis and customization might not be as comprehensive as specialized expense management tools. This factor is worth considering if detailed expense tracking is a critical aspect of your projects.

5. Limited Project Management Features:

While Xero offers project tracking and time management capabilities, its features are more limited than dedicated tools. If your projects require intricate task dependencies and advanced project planning, you might find the project management functionalities of Xero to be somewhat constrained.

Pros:

- Seamless integration of invoicing with financial and project data.

- Robust time tracking capabilities for accurate project monitoring.

- Wide range of third-party app integrations for enhanced functionality.

- Cloud-based accessibility ensures remote collaboration.

- Scalable pricing plans cater to businesses of various sizes.

Cons:

- Limited expense tracking compared to specialized tools.

- Project management features might be basic for complex projects.

- Initial setup for third-party app integration might require some effort.

- Pricing can be relatively higher for smaller businesses.

- Learning curve for users unfamiliar with accounting software.

Pricing Plans:

- Early: $9 per month

- Growing: $30 per month

- Established: $60 per month

Customer Ratings:

- G2: 4.2/5 based on 7,000+ reviews

- Capterra: 4.3/5 based on 6,000+ reviews

Our Review:

Xero excels in blending financial and project management tasks, particularly with its invoicing and time tracking capabilities. While its project management features are more basic, it shines in providing a user-friendly interface and third-party app integrations.

Businesses seeking efficient financial management with moderate project coordination needs will find Xero to be a valuable asset. The pricing plans cater to various business sizes, making it suitable for businesses at different stages of growth.

Exploring options to replace Xero? These project management tools offer a multitude of choices.

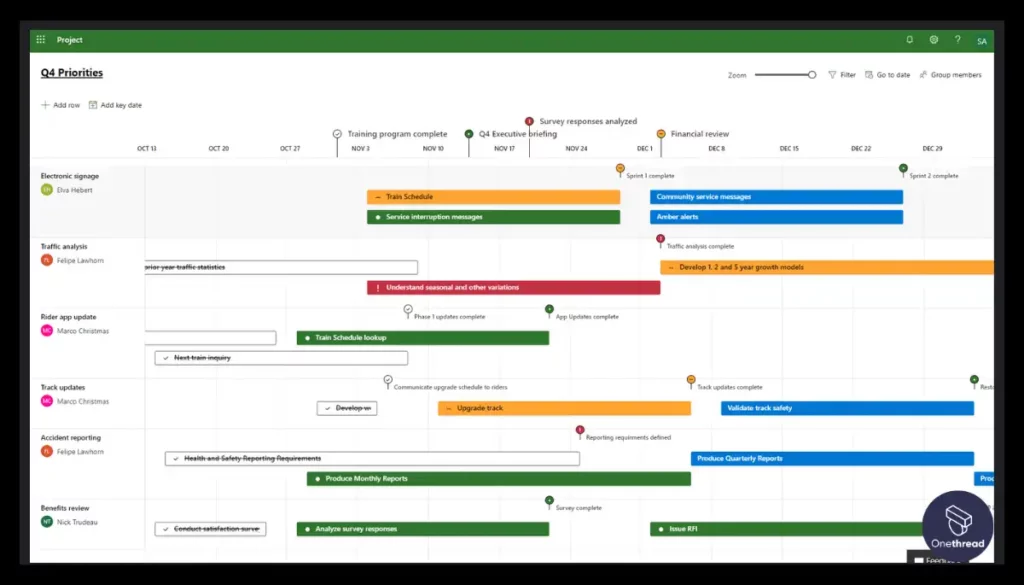

#4. Microsoft Project

Microsoft Project is a powerful project management software designed to help teams plan, execute, and monitor projects effectively. With intuitive features, users can create detailed project schedules, allocate resources, and track progress.

The software offers various views, including Gantt charts and timeline views, making it easy to visualize project timelines and dependencies. Microsoft Project integrates seamlessly with other Microsoft Office tools, enhancing collaboration and data sharing.

It offers robust reporting capabilities, enabling users to generate insightful project reports and presentations. Whether managing simple tasks or complex projects, Microsoft Project provides the tools needed to streamline workflows, improve communication, and ensure project success.

Microsoft Project: A Company Snapshot

Company Valuation

- Microsoft Project is a product of Microsoft, a publicly traded company.

- Valuation details might be $100B specified solely for the Microsoft Project.

Employee Numbers

- Founded in [1984].

- Operated by the team at Microsoft, which had [500-600] employees as of 2021.

- Focused on providing project management and collaboration solutions.

Founding Team

- Microsoft Project is part of Microsoft’s suite of products.

- Microsoft was co-founded by Bill Gates and Paul Allen, who played instrumental roles in its growth.

Features

Microsoft Project is a robust Accounting Project Management Software that excels in project coordination and financial management integration. Here, we explore five standout features that position Microsoft Project as a top choice for businesses seeking comprehensive solutions:

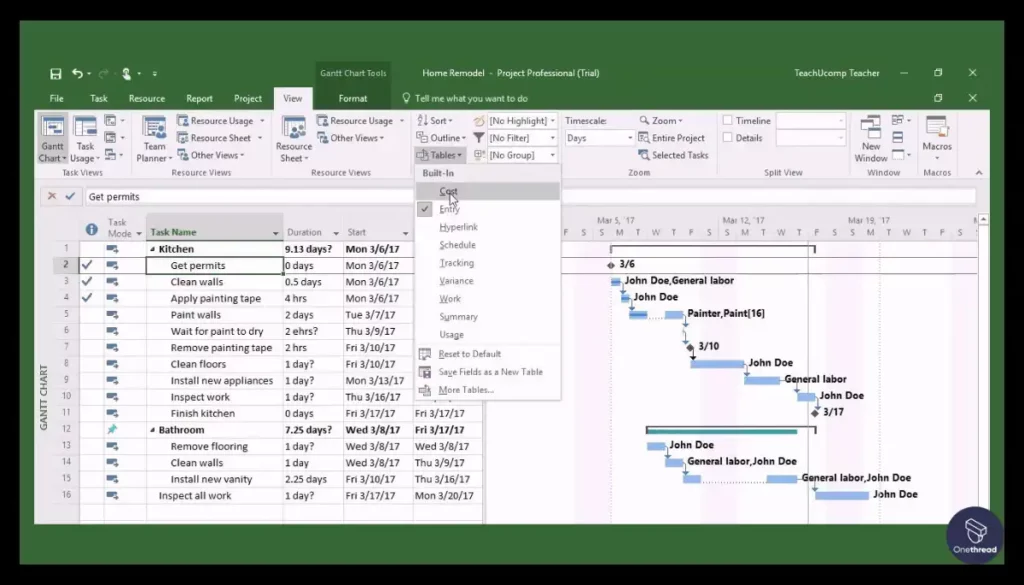

1. Extensive Project Tools:

Microsoft Project’s strength lies in its extensive array of project management tools. From Gantt charts to task scheduling, it offers a comprehensive suite of features that empower project managers to plan, execute, and monitor projects effectively. This suite of tools ensures that your projects are well-organized, on track, and aligned with your financial goals.

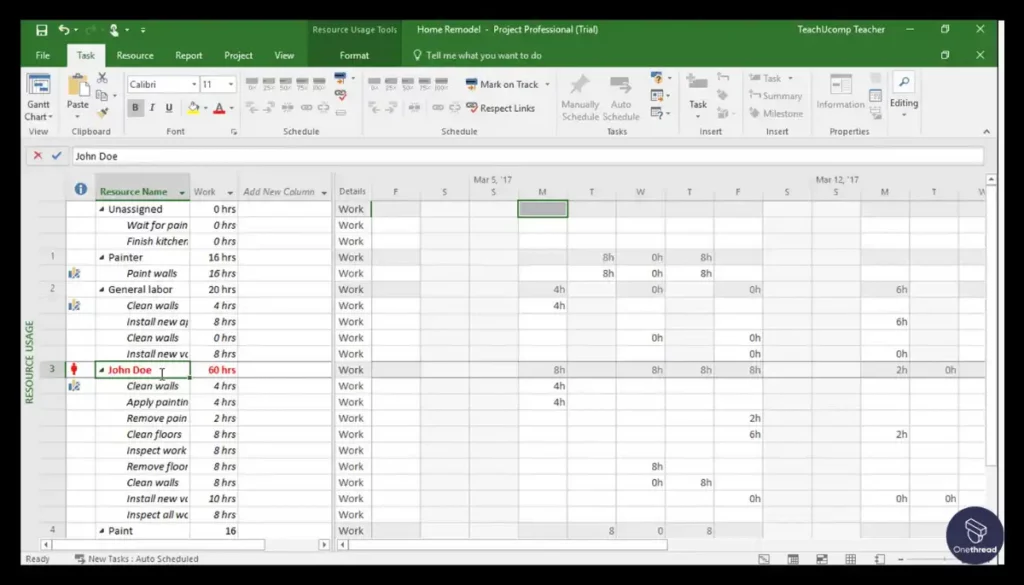

2. Advanced Resource Allocation:

Resource allocation is a breeze with Microsoft Project. Its advanced features allow you to assign tasks based on team availability and skill sets, ensuring optimal resource utilization. This functionality minimizes bottlenecks and optimizes project efficiency, positively impacting your financial bottom line.

3. Limited Financial Tracking:

While Microsoft Project shines in project management, its financial tracking capabilities are more limited compared to dedicated accounting tools. Although you can manage project budgets and expenses, the depth of financial analysis and customization might not match specialized accounting software.

4. Expansive Integration Options:

Microsoft Project offers integration with other Microsoft tools like Excel and Teams, fostering a collaborative environment. While this enhances communication and data sharing, it might require a learning curve for users new to the Microsoft ecosystem. Additionally, integrating with specialized accounting software could require additional configuration.

5. Comprehensive Project Planning:

With its project planning capabilities, Microsoft Project enables you to break down complex projects into manageable tasks and timelines. This feature enhances project coordination and helps you align project objectives with financial goals, ultimately ensuring the success of your projects.

Pros:

- Extensive project management tools for efficient project planning.

- Advanced resource allocation features for optimized resource utilization.

- Integration with other Microsoft tools fosters collaboration.

- Cloud-based accessibility allows remote project coordination.

- Scalable pricing plans cater to different business sizes.

Cons:

- Limited financial tracking compared to dedicated accounting software.

- Learning curve for users new to Microsoft’s suite of tools.

- Integration with specialized accounting software might require additional effort.

- Project management features might be overly comprehensive for simpler projects.

- Pricing might be relatively higher for smaller businesses.

Pricing Plans:

- Project Plan 1: $10 per user/month

- Project Plan 3: $30 per user/month

Customer Ratings:

- G2: 4.2/5 based on 500+ reviews

- Capterra: 4.2/5 based on 600+ reviews

Our Review:

Microsoft Project’s strength lies in its extensive project management capabilities, making it ideal for businesses seeking robust project planning and coordination. While its financial tracking features might not match dedicated accounting tools, its integration with other Microsoft tools enhances collaboration.

Businesses already familiar with the Microsoft ecosystem will find this tool seamless to integrate, while others might require a learning curve. The pricing plans cater to businesses of varying sizes, making it a versatile option for businesses seeking in-depth project management solutions.

Need a change from Microsoft Project? These project management alternatives provide a spectrum of features.

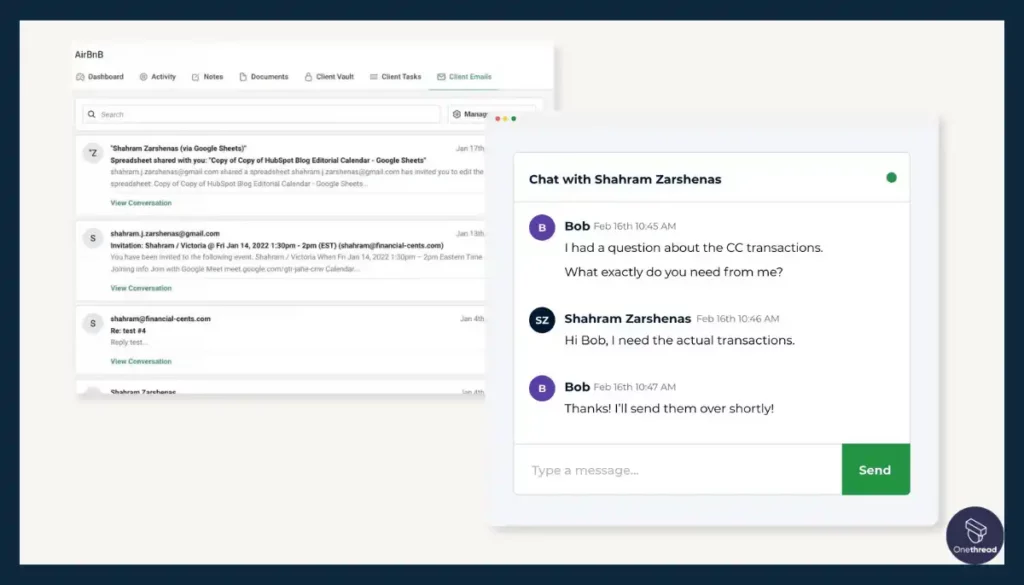

#5. Financial Cents

Financial Cents is a user-friendly personal finance management software designed to help individuals take control of their finances. Its intuitive interface lets users easily track income, expenses, and budget goals.

The software offers expense categorization, budget planning, and goal-tracking features, allowing users to gain insights into their spending habits and make informed financial decisions.

Financial Cents also provides tools for debt management and savings planning, helping users work towards their financial objectives. It supports various account types and allows users to import transactions from bank statements, simplifying the tracking process.

Financial Cents: About the Product

- Employee Numbers: <25 employees.

Founding Team:

- Shahram Zarshenas: Shahram Zarshenas, the visionary behind Financial Cents.

Features

Below, we delve into five key features that make Financial Cents a standout choice for businesses seeking efficiency and effectiveness:

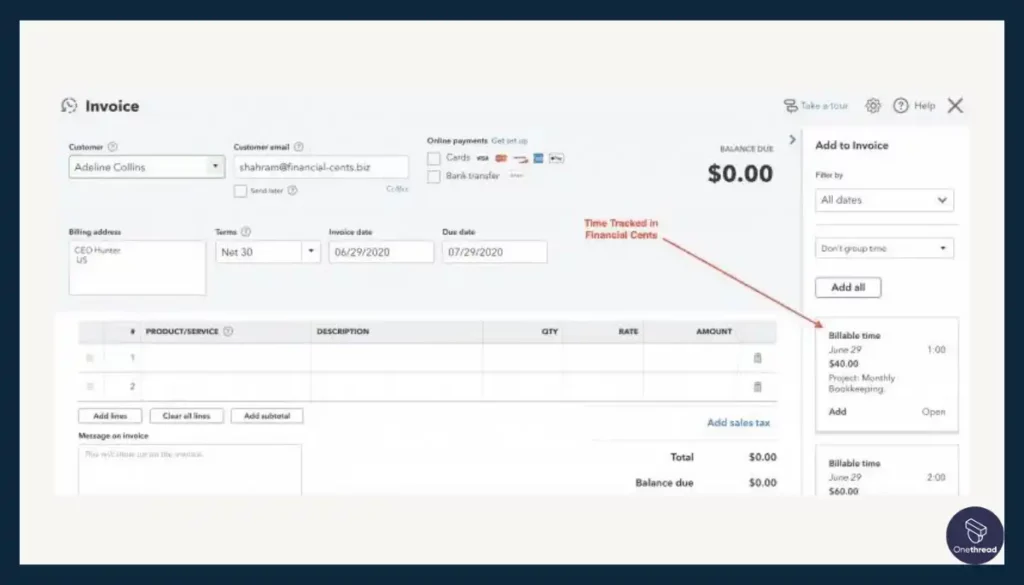

1. Invoicing and Billing Capabilities:

Financial Cents excels in providing advanced invoicing and billing capabilities. With customizable templates, you can create professional invoices that align with your brand identity. This feature streamlines cash flow management and ensures prompt payment processing, making it an essential tool for maintaining financial stability across your projects.

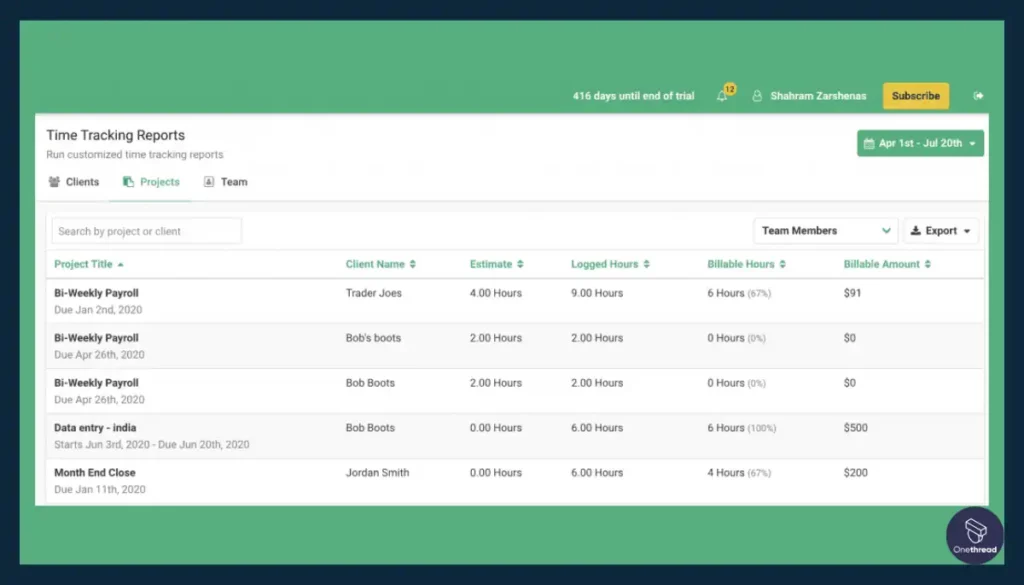

2. Time Tracking and Monitoring:

Time tracking is a breeze with Financial Cents. It offers robust time tracking capabilities that enable you to monitor billable hours and project progress accurately. This functionality ensures that your projects stay on schedule and within budget, making it an invaluable asset for project managers and financial teams alike.

3. Integrations for Enhanced Functionality:

Financial Cents offers seamless integration with third-party apps, enhancing its capabilities beyond traditional accounting software. By connecting with project management tools like Trello or Asana, you can integrate project-specific data with financial insights, promoting cross-functional collaboration and informed decision-making.

4. Limited Expense Tracking:

While Financial Cents excels in invoicing and time tracking, its expense tracking capabilities might have limitations compared to specialized expense management tools. Although you can manage business expenses, in-depth analysis, and customization might not be as comprehensive as standalone expense management software.

5. Collaborative Workspace:

Financial Cents fosters a collaborative workspace, enabling effective communication among team members. Within the software, you can share files, assign tasks, and discuss project updates, enhancing transparency and reducing the likelihood of miscommunication.

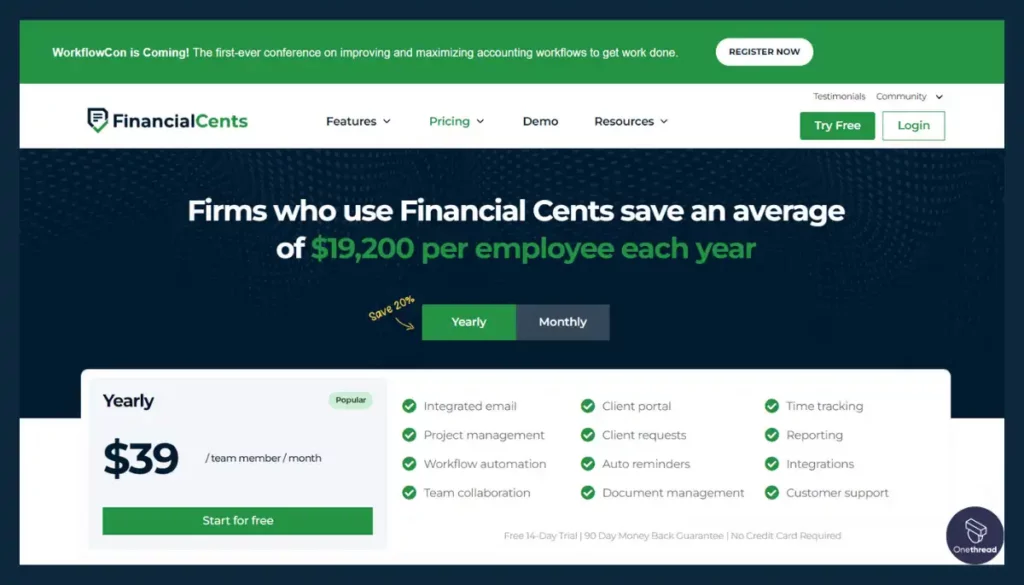

Pros:

- Advanced invoicing options for professional billing.

- Robust time tracking capabilities for accurate project monitoring.

- Seamless integration with third-party apps for enhanced functionality.

- Collaborative workspace feature fosters effective communication.

- Pricing plans cater to various business sizes and budgets.

Cons:

- Expense tracking capabilities might be limited compared to specialized tools.

- Project management features could be more robust for complex projects.

- Initial setup for third-party app integration might require additional effort.

- Learning curve for users new to accounting software.

- Pricing may not suit very small businesses.

Pricing Plans:

- Basic Plan: $15 per month

- Standard Plan: $30 per month

- Professional Plan: $60 per month

Customer Ratings:

- G2: 4.1/5 based on 200+ reviews

- Capterra: 4.2/5 based on 250+ reviews

Our Review:

Financial Cents shines with its advanced invoicing and time tracking capabilities, making it a solid choice for businesses prioritizing financial management integration. While its project management features might not be as comprehensive as dedicated tools, its collaborative workspace fosters cross-team communication.

Businesses seeking seamless collaboration between accounting and project management teams will find Financial Cents to be a valuable asset. The pricing plans offer flexibility, making it suitable for businesses of varying sizes and growth stages.

Looking to diversify your project management experience? Check out these Financial Cents alternatives.

Getting the Most Out of Accounting Project Management Software.

Efficiency and effectiveness come hand in hand when utilizing Accounting Project Management Software. Here are some best practices to optimize your experience and achieve seamless financial management and project coordination:

- Clear Workflow Alignment: Ensure your team understands how the software integrates financial and project tasks for a cohesive workflow.

- Customize for Your Needs: Tailor the software to your business requirements to maximize functionalities and match your processes.

- Regular Training: Conduct regular training sessions to update your team on new features and best practices.

- Accurate Data Input: Maintain accurate and up-to-date data to make informed financial and project decisions.

- Collaboration Hub: Utilize collaborative features to enhance communication and teamwork among departments.

- Regular Updates: Stay up-to-date with software updates to benefit from improvements and new features.

- Integration Strategies: Explore third-party integrations to boost functionality and streamline tasks.

- Regular Analysis: Regularly review financial and project data to identify areas for improvement.

By implementing these best practices, you can harness the full potential of Accounting Project Management Software and drive your business toward enhanced efficiency and success.

Summary

Accounting Project Management Software revolutionizes business operations by seamlessly integrating financial management and project coordination. Real-time insights, collaborative features, and customizable functionalities empower businesses to enhance efficiency and accuracy.

By effectively managing financial tasks and project workflows, this software leads to streamlined success and improved team collaboration.

FAQs

Is Accounting Project Management Software suitable for small businesses?

Yes, many software options offer scalable pricing plans, making them suitable for businesses of various sizes, including startups and small enterprises.

Can I customize reports in these software solutions?

Yes, most Accounting Project Management Software options provide customizable reporting features, allowing you to tailor reports to specific business needs.

Can I collaborate with my team using these tools?

Absolutely, collaborative workspaces are a common feature, enabling team members from different departments to work together, share files, and communicate effectively.

Are there any limitations to consider?

While these tools offer integration, some may have limited expense tracking or less advanced project management features than standalone tools.