In the fast-paced world of digital professions, where creativity knows no bounds, it’s easy to get swept up in the thrill of your work. But here’s a fact that might give you pause: According to a recent survey conducted by Freelancers Union and Upwork, over 70% of freelancers have encountered clients who don’t pay them on time.

That’s a significant hurdle for professionals in the digital realm who rely on timely payments to keep their creative engines running. Fear not, though, because we’re about to dive into the digital toolkit that can transform your invoicing woes into seamless financial success.

In this article, we’ll unveil the top 5 online invoicing tools designed with digital professionals in mind. Whether you’re a freelance designer, a content creator, or a digital marketer, these tools are your digital accountants, helping you streamline invoicing, get paid promptly, and focus on what you do best—creating digital magic.

Join us on this journey as we explore the software that could revolutionize your financial management in the world of digital creativity.

Quick List of 5 Online Invoicing Tools

- Zapier: Cloud-based solution tailored for small business needs.

- QuickBooks Online: Comprehensive invoicing with integrated financial tools.

- Yooz: Simplified invoicing with multilingual capabilities.

- Hopscotch: Free invoicing for freelancers and entrepreneurs.

- FreshBooks: Open-source platform for customizable billing processes.

Our reviewers evaluate software independently. Clicks may earn a commission, which supports testing. Learn how we stay transparent & our review methodology

Comparison Chart Of Online Invoicing Tools

This chart provides an overview of the invoicing tools based on known features

Tool Name | Invoice Creation | Payment Integration | Expense Tracking | Reporting Features |

| Automated Invoice Workflow | Multi-App Payment Links | Not Supported | Not Supported |

| Custom Invoice Templates | Integrated QuickBooks Payments | Real-Time Expense Sync | Advanced Financial Reports |

| Dynamic Invoice Capture | Direct Bank Integration | Automated Expense Coding | Custom Dashboards |

| One-Click Invoicing | Stripe, PayPal | Basic Expense Logging | Basic Financial Overviews |

| Double-Entry Accounting Invoices | FreshBooks Payments, Credit Card, ACH | Automated Expense Import | Comprehensive Reports |

What Are Online Invoicing Tools?

Online invoicing tools are digital platforms or software applications that enable businesses and freelancers to create, send, and manage invoices electronically. These tools streamline the invoicing process, making it more efficient and organized compared to traditional paper-based methods.

Online invoicing tools are like the GPS systems for your financial journey. Just as a GPS guides you on the road, avoiding traffic and ensuring you reach your destination efficiently, online invoicing tools navigate the complexities of billing.

They steer clear of manual errors, speed up payment routes, and ensure a smooth financial journey for your business. Just plug in the details, and let the system chart the best course for your invoicing needs.

How Online Invoicing Tools Can Help Your Business?

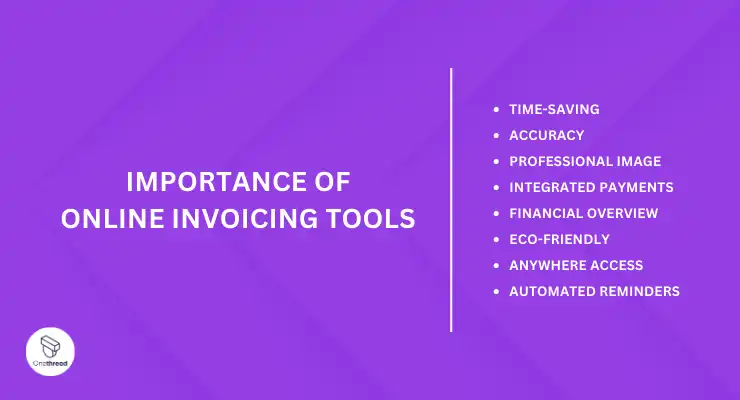

In today’s fast-paced digital age, every minute counts. Online invoicing tools serve as a bridge to efficiency, linking businesses to streamlined financial management.

- Time-saving: Automated processes mean quicker invoice creation.

- Accuracy: Reduces human errors in calculations or details.

- Professional Image: Sends polished, consistent invoices to clients.

- Integrated Payments: Offers multiple payment options, encouraging timely payments.

- Financial Overview: Provides real-time insights into your cash flow.

- Eco-friendly: Eliminates the need for paper, contributing to sustainability.

- Anywhere Access: Cloud-based systems allow invoice management on-the-go.

- Automated Reminders: Sends notifications for due or overdue payments.

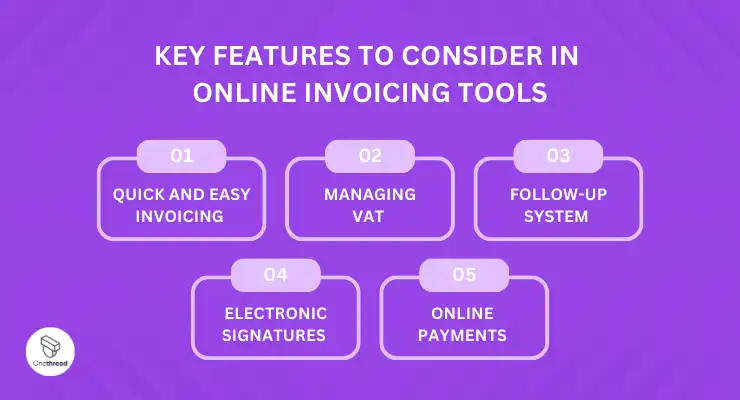

Key Features to Consider in Online Invoicing Tools

Navigating the world of online invoicing tools can be a challenge. But fear not. Knowing the right features to look for simplifies the process. Let’s break down these must-have features.

Quick and Easy Invoicing

An ideal tool lets you draft invoices fast. Time is money. The faster you invoice, the faster you get paid. Look for tools with templates. They speed up the process. You want intuitive designs and simple interfaces. These save time.

Managing VAT

VAT can be tricky. Your tool should simplify it. It should calculate and apply VAT rates automatically. This ensures compliance. It also removes guesswork. For international clients, variable VAT rates might apply. Your tool should handle these with ease.

Follow-up System

Payments sometimes get delayed. Your tool should remind you and your clients. Automatic reminders are a boon. They keep cash flowing. You remain on top of outstanding payments. No need to track manually.

Electronic Signatures

Contracts often need signatures. Electronic signatures make this process seamless. They’re fast. They’re secure. And they’re legally recognized. Ensure your tool supports them. It reduces paperwork and accelerates agreements.

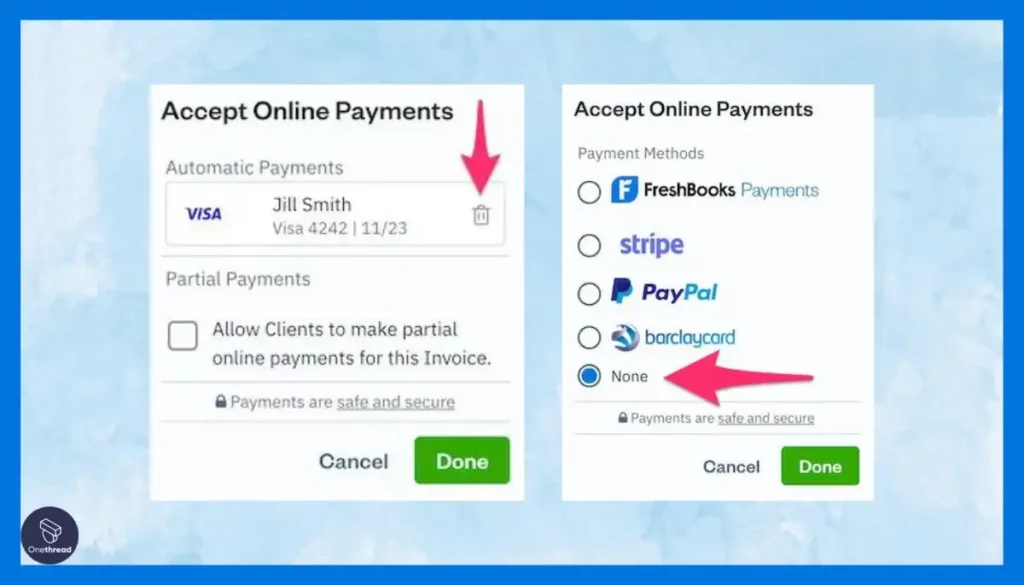

Online Payments

Clients prefer easy payment options. Your invoicing tool should provide them. It should integrate with popular payment gateways. This increases the chances of on-time payments. It also offers clients flexibility in how they pay.

A robust online invoicing tool should be a blend of simplicity and functionality. It should make your financial tasks straightforward. Prioritize these features for a smooth invoicing experience.

Top 5 Online Invoicing Tools

When it comes to billing and financial management, the tools you choose can make or break the flow. Among the myriad of options, five online invoicing tools stand out, offering a blend of simplicity, robust features, and seamless user experience.

#1. Zapier

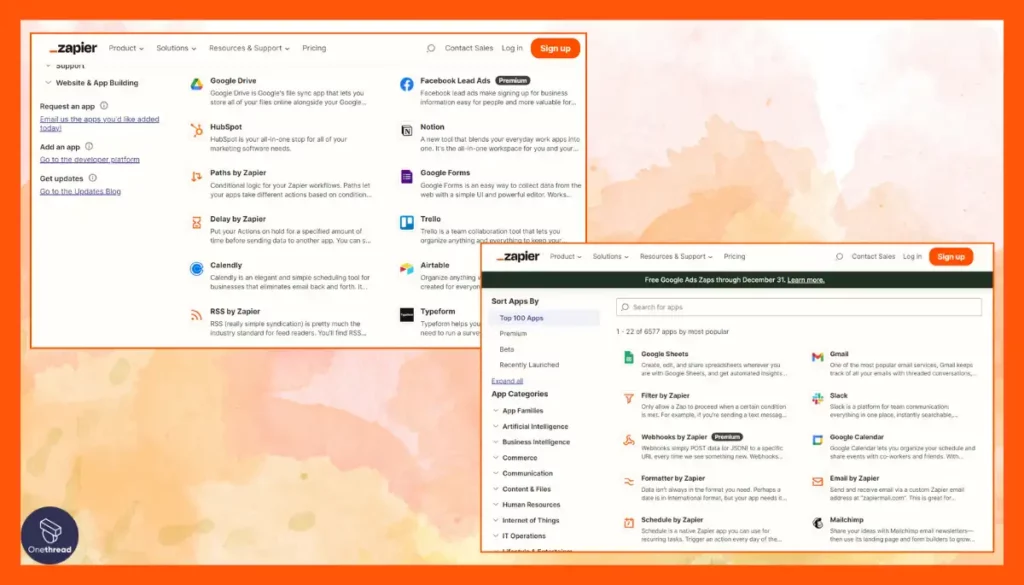

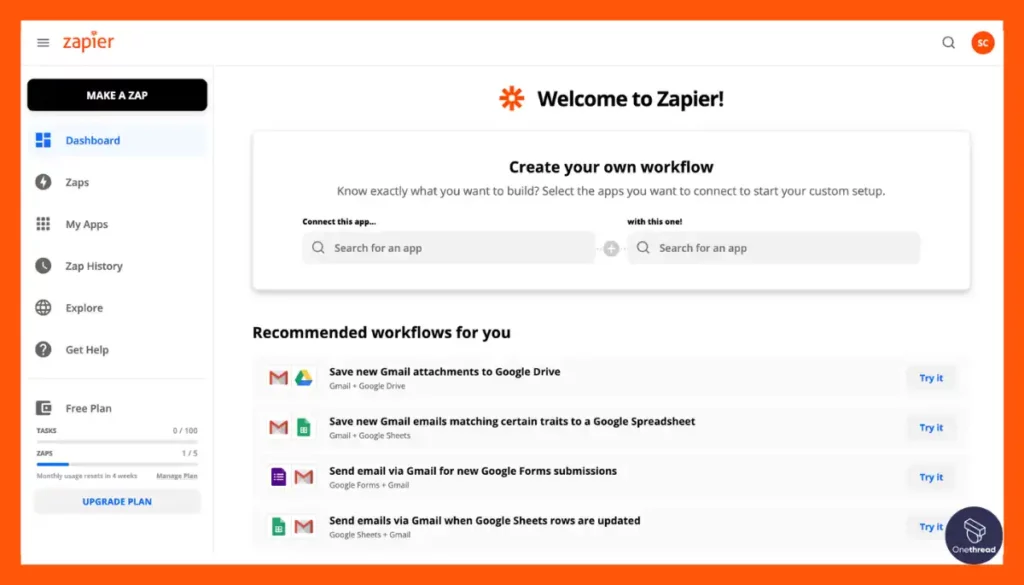

Zapier, a versatile online automation tool, offers a smart solution for your invoicing needs. With its user-friendly interface, Zapier connects various invoicing tools, making your billing process efficient.

Create “Zaps” to automate repetitive invoicing tasks, like generating invoices from spreadsheet data or sending payment reminders. Zapier seamlessly integrates with popular invoicing platforms, reducing manual work and minimizing errors.

Whether you’re a freelancer or a small business owner, Zapier’s flexibility and ease of use make it a valuable ally in managing your online invoicing tasks. Say goodbye to invoicing headaches and embrace streamlined efficiency with Zapier.

Zapier Overview:

- Company Valuation: Zapier has 800 employees.

- Employee Numbers: $5 billion

- Founding Team: Zapier was co-founded by Wade Foster, Bryan Helmig, and Mike Knoop.

Features

App Integration

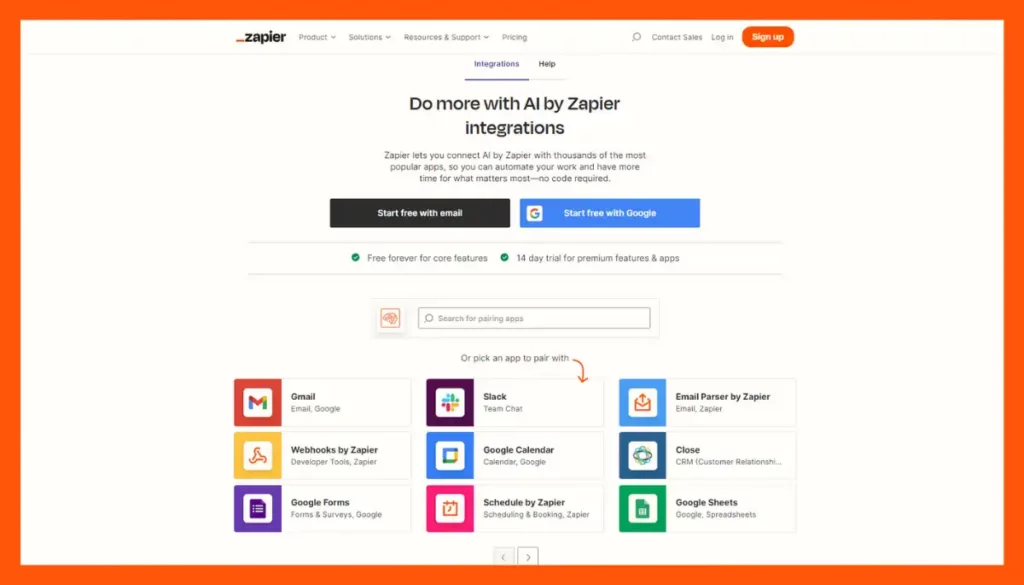

Zapier supports more apps than any other platform, making it incredibly versatile. You can integrate it with your preferred invoicing software, CRM, and email services. This feature enables you to automate the invoicing process, from generating invoices to sending reminders.

Custom Workflows

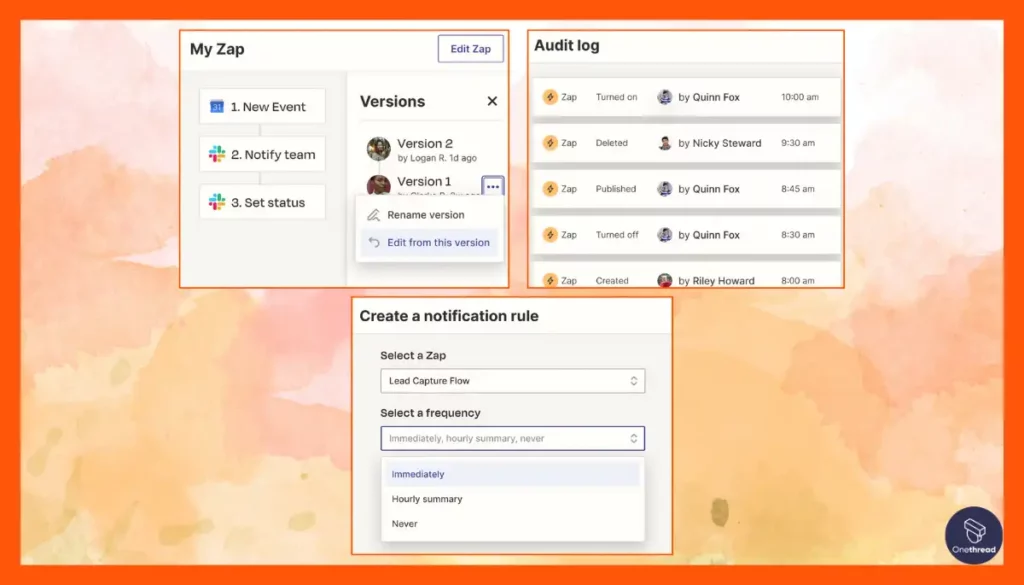

Zapier allows you to build custom workflows in minutes. You can set up triggers and actions to automate the entire invoicing process. For example, when a project is marked as complete in your project management tool, Zapier can automatically generate an invoice.

No-Code Automation

With Zapier, you don’t need to know how to code to set up automation. The platform offers a user-friendly interface where you can simply describe what you’d like to automate, and Zapier will do the rest. This feature is particularly useful for freelancers who may not have coding skills.

AI-Powered Tools

Zapier brings the power of AI to your invoicing process. You can create custom AI chatbots to answer customer questions about invoices or even use AI tools like OpenAI to draft invoice descriptions. This feature adds a layer of sophistication to your invoicing process.

Data Management

Zapier Tables allows you to store, manage, and take action on your invoicing data. You can keep track of all your invoices, payments, and clients in one place. This centralized data management system makes it easier to maintain accurate records.

Pros & Cons

Pros

- Extensive app integration

- Customizable workflows

- No-code automation

- AI-powered features

- Robust data management

Cons

- Not a dedicated invoicing tool

- May require a learning curve for beginners

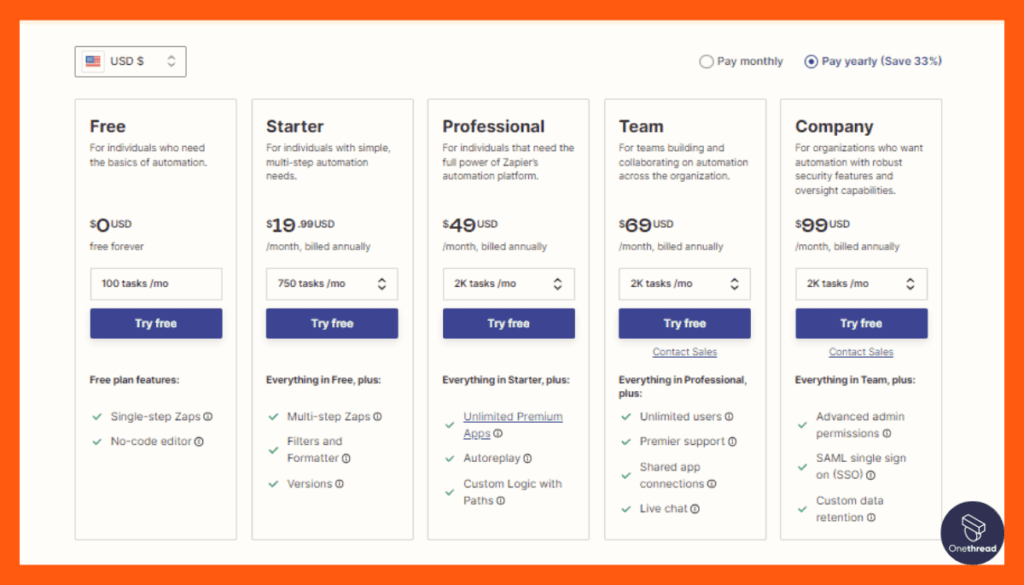

Pricing Plans

- Free Plan: Limited features, suitable for individual freelancers.

- Starter Plan: ($19), designed for small businesses.

- Professional Plan: ($49), tailored for larger operations.

- Team Plan: ($69)

Customer Ratings

- G2: 4.4 out of 5 stars

- Capterra: 4.7 out of 5 stars

Review

We’ve been using Zapier to automate our workflow, and it’s been a game-changer. The ease of setting up automated tasks, or “Zaps,” is a huge plus. We can connect various apps and tools, reducing manual work.

However, the pricing can be a bit high for heavy users. The free plan has limitations, and the costs can add up as your automation needs grow. Also, some complex tasks may require a learning curve.

Zapier is fantastic for automating routine tasks and integrating apps. It saves time and reduces errors. But, for budget-conscious users or those with highly intricate workflows, exploring the pricing and learning curve is essential to determine if it’s the right fit.

#2. QuickBooks Online

QuickBooks Online is a user-friendly accounting software. It simplifies financial management for businesses of all sizes.

With QuickBooks Online, you can easily handle your company’s finances. It offers features like invoicing, expense tracking, and financial reporting, making it ideal for entrepreneurs and small business owners.

You can connect your bank accounts, categorize transactions, and monitor cash flow, helping you make informed financial decisions. Accessible on both desktop and mobile devices, QuickBooks Online adapts to your work style.

QuickBooks Online is a valuable solution for streamlined financial management and improved financial visibility.

QuickBooks Online – Overview

- Focus: Cloud-based accounting software for businesses.

- Parent Company: Intuit Inc.

Founding Team of Intuit Inc. (the company behind QuickBooks Online):

- Scott Cook:

- Position: Co-founder.

- Tom Proulx:

- Position: Co-founder.

Features

QuickBooks Online isn’t just a tool. It’s a solution. It has served millions globally. Its reputation speaks volumes. Here’s an in-depth look at this acclaimed invoicing platform.

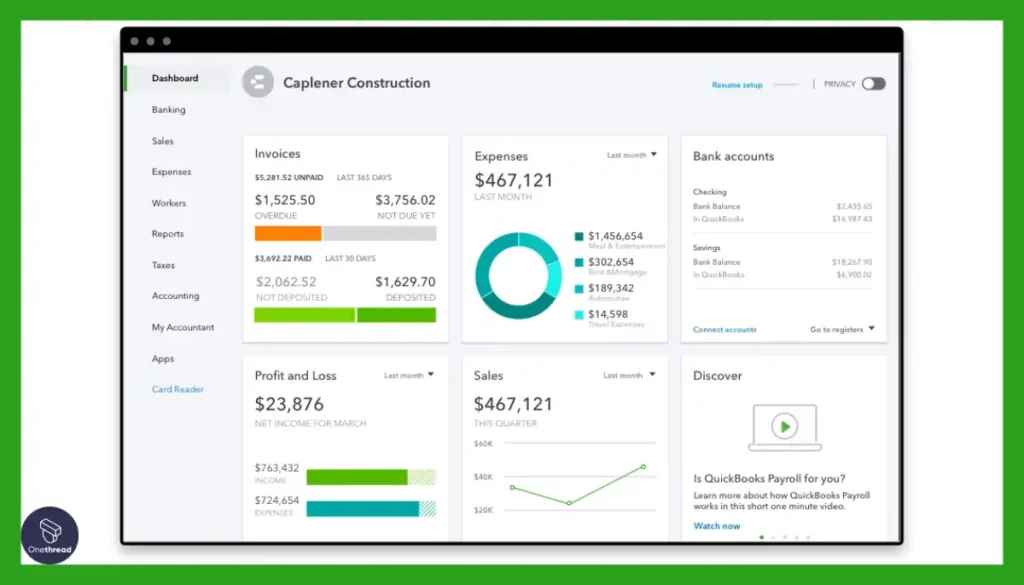

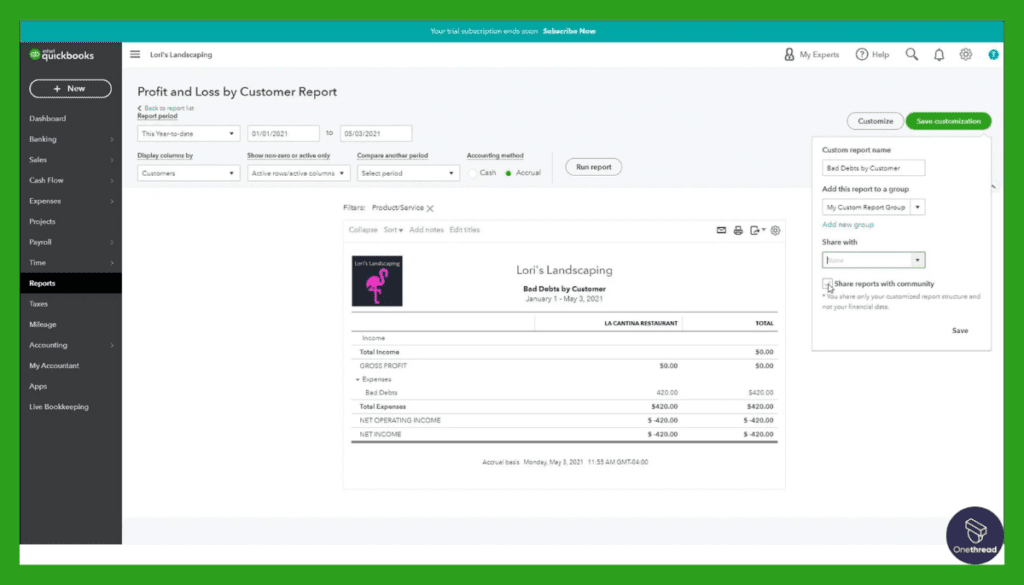

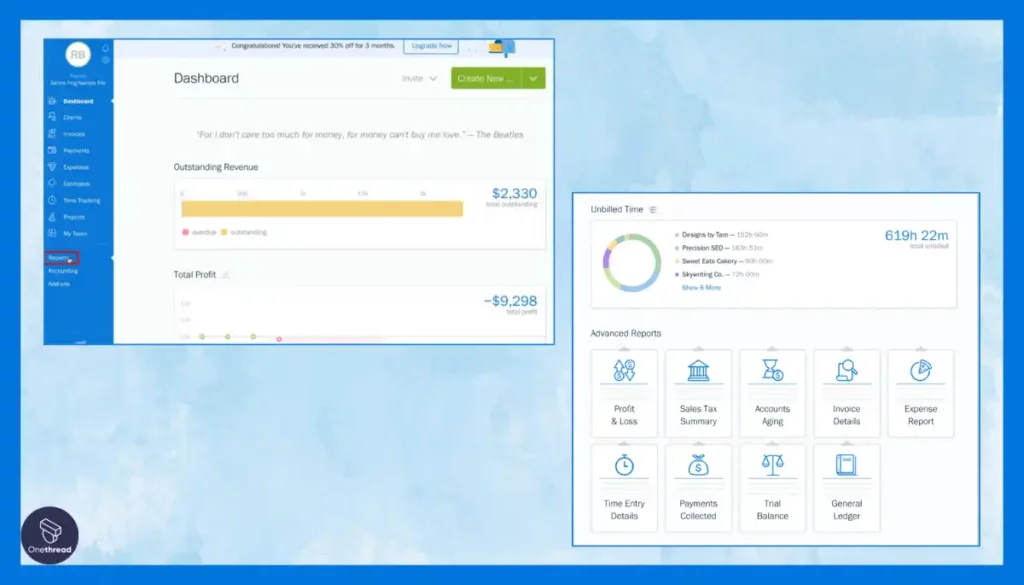

1. Comprehensive Dashboard

The dashboard stands out. It offers a clear overview. Users see finances at a glance. Income, expenses, and overdue invoices are visible. This central hub drives decision-making.

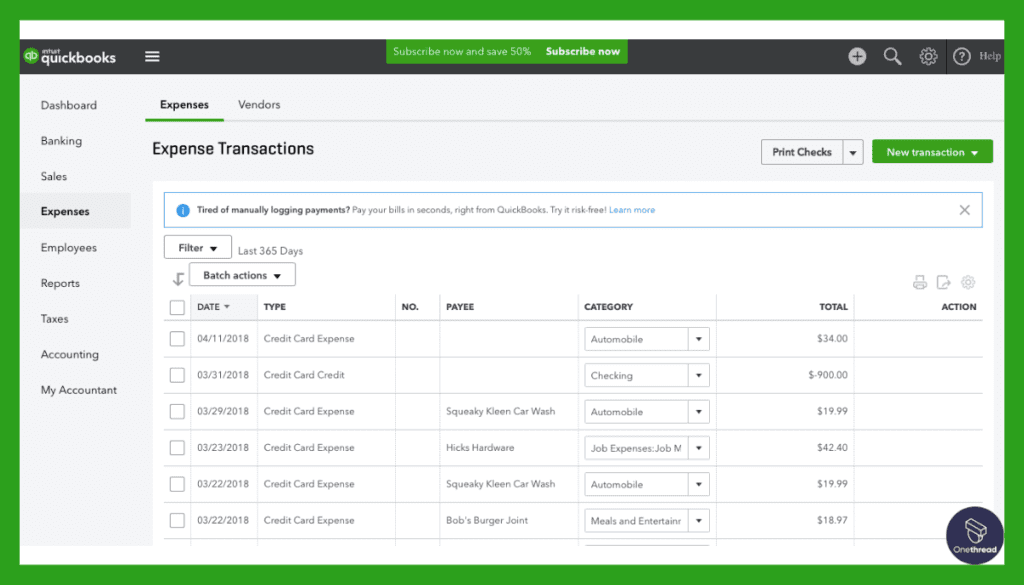

2. Advanced Expense Tracking

Every penny matters. QuickBooks Online gets that. It categorizes and tracks expenses. This simplifies tax filing. Users can link their bank accounts. This ensures real-time data accuracy.

3. Time-Saving Automation

Time is a precious asset. This tool maximizes it. Recurring invoices are automated. Payment reminders are sent without prompts. This reduces manual intervention. Efficiency is the result.

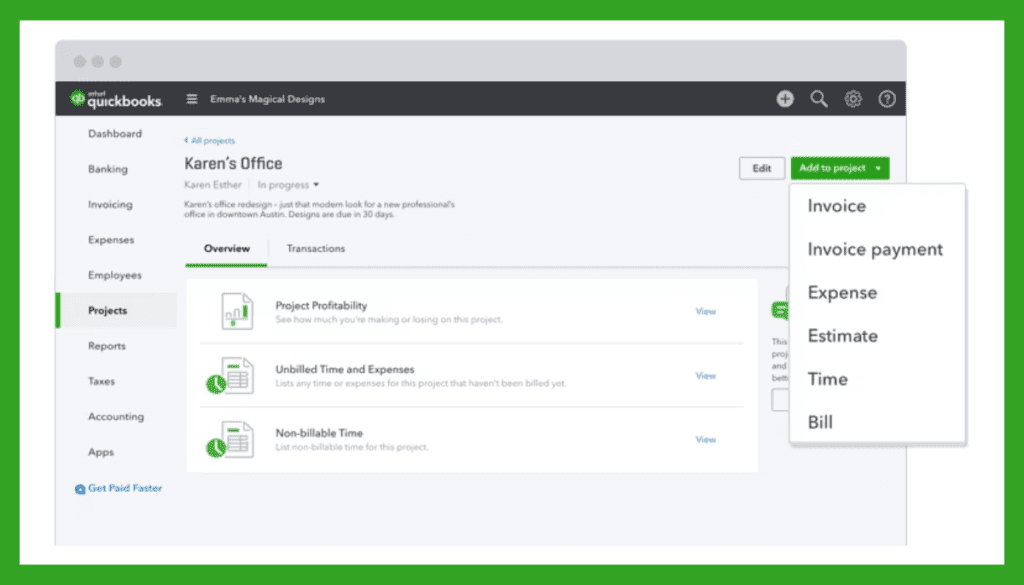

4. Intuitive Project Tracking

Projects bring income. Tracking them is essential. QuickBooks Online offers this. Users see project profitability. They identify what’s working. They also spot potential issues early.

5. Comprehensive Reporting

Data drives decisions. QuickBooks Online delivers detailed reports. They cover profit and loss. They also delve into expenses. Users gain insights. They can chart growth strategies confidently.

Pros & Cons

Pros:

- Syncs with many apps and tools.

- Beyond invoicing, it offers accounting solutions.

- Ensures user data safety.

- Tailors invoices to brand identity.

- Access from anywhere, anytime.

Cons:

- Might be steep for small businesses.

- Some users might find it complex initially.

- Some users reported minor syncing delays.

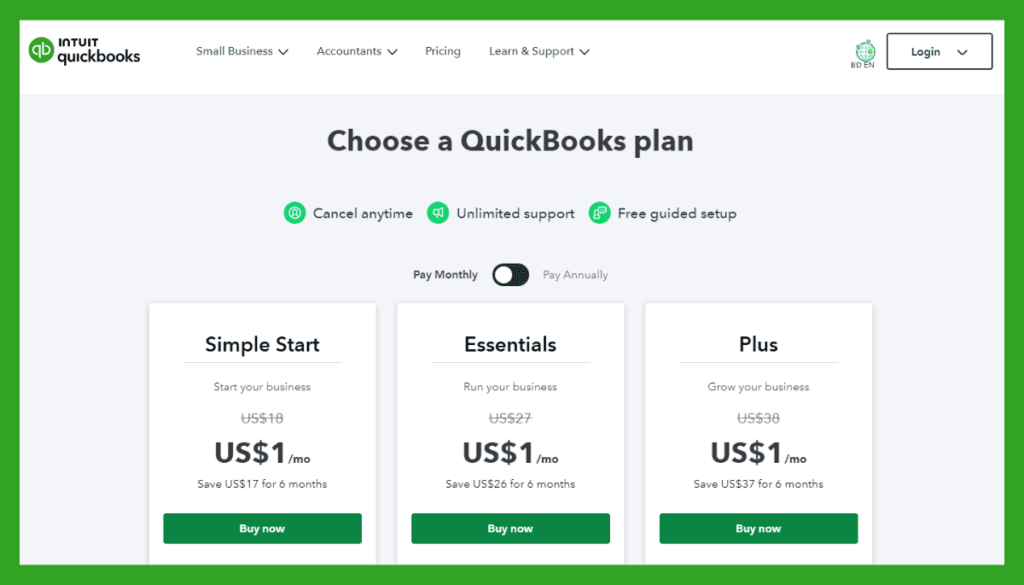

Pricing Plans

- Simple Start: For solo entrepreneurs.

- Essentials: For small businesses wanting advanced features.

- Plus: Designed for growing businesses with more complex needs.

Customer Ratings

- G2: 4.3/5

- Capterra: 4.5/5

Our Review

QuickBooks Online is a versatile accounting software that simplifies financial management. We appreciate its user-friendly interface. It makes navigating through finances a breeze.

On the positive side, QuickBooks Online offers time-saving automation. We love the way it handles invoicing, tracking expenses, and generating reports effortlessly. It’s a lifesaver for small businesses.

However, we have some gripes too. The pricing can get steep as your business grows. The basic plan might not cover all your needs, pushing you into higher-priced tiers.

Also, customer support isn’t always top-notch. Sometimes, we’ve had to wait longer than we’d like for assistance.

QuickBooks Online is a solid choice for businesses looking to streamline their finances. It’s easy to use, but the cost and customer support could be better. We’d recommend it for small to medium-sized businesses..

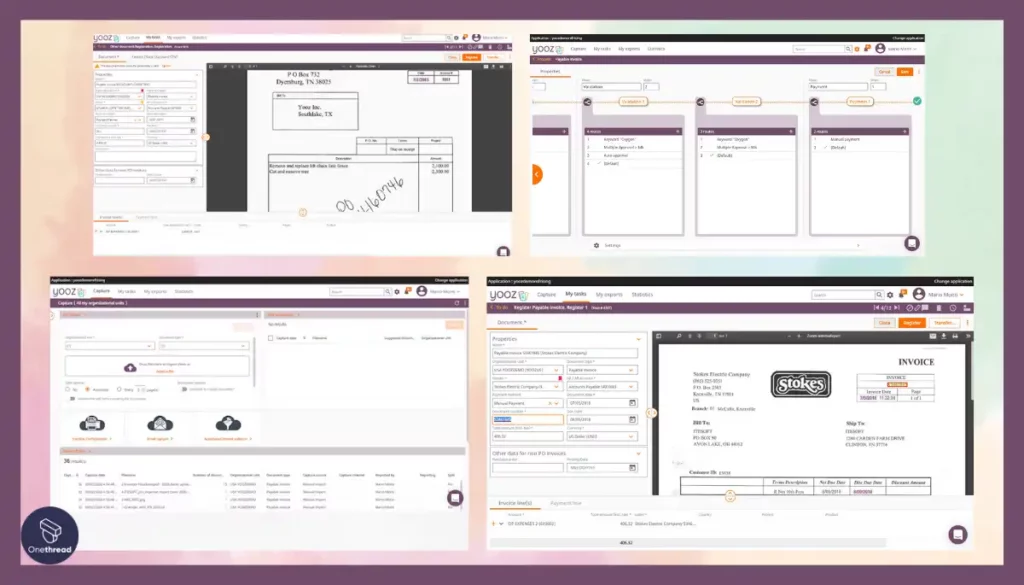

#3. Yooz

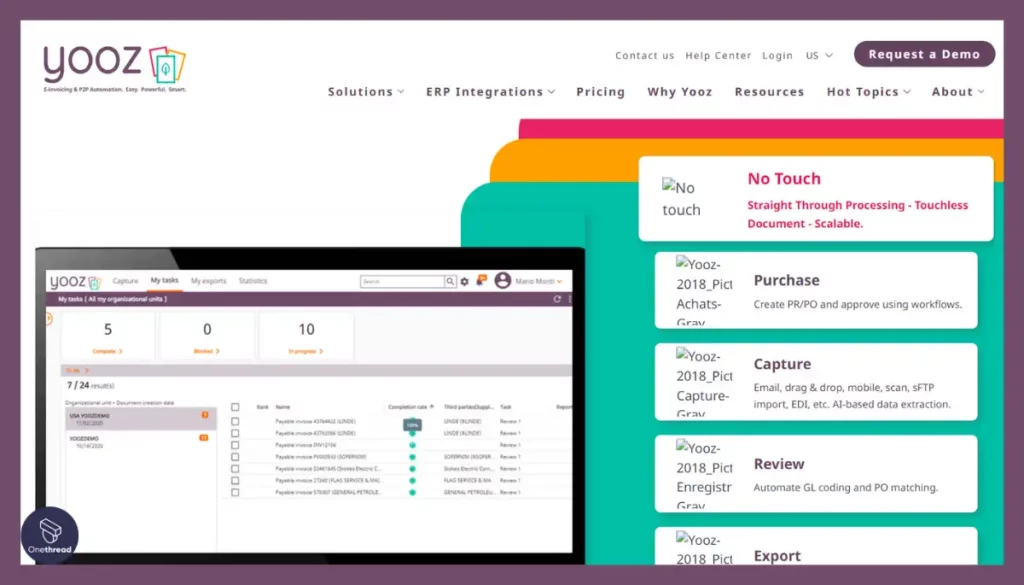

Yooz is a user-friendly software for businesses looking to automate and optimize their invoice processing. With Yooz, you can easily capture, process, and approve invoices electronically.

The platform uses advanced AI and machine learning to extract data accurately, reducing manual data entry errors. It also offers customizable workflows to match your company’s specific needs.

Yooz is accessible from any device with an internet connection, making it convenient for remote work and on-the-go approvals.

Yooz is a credible and efficient solution for automating accounts payable. Its user-friendly interface, advanced AI capabilities, and customizable workflows make it a valuable asset for businesses aiming to improve their financial processes.

Yooz – Overview

- Focus: Cloud-based accounts payable automation software.

- Employee Numbers: 30+

Founding Team:

- CAI Yuedong:

- Position: Co-founder and CEO.

- Eric Tobias:

- Position: Co-founder and CTO.

- Xavier Sillon:

- Position: Co-founder and COO.

Features

Businesses large and small trust Yooz abd its reputation is growing. Here’s why.

1. Cloud-Based Automation

Yooz stands tall with cloud technology. Its platform is powerful. It processes invoices without manual input. Users simply upload, and Yooz does the rest. This ensures speed and accuracy.

2. Intelligent Data Capture

Data capture is critical. Yooz masters this. Its smart system identifies invoice details. It pulls necessary data effortlessly. This reduces entry errors. It guarantees precision.

3. Secure Workflow Approvals

Approvals are streamlined. Yooz introduces multi-level validation. Managers can approve or reject on the go. This minimizes payment delays. It promotes efficient cash flow management.

4. Seamless Integrations

Yooz plays well with others. It integrates with major ERPs. This includes QuickBooks and Sage. Data flow is uninterrupted. This creates a cohesive financial ecosystem.

5. Detailed Analytics

Yooz isn’t just about invoices. It’s about insights. The platform offers deep analytics. Users can track KPIs. They can monitor processing times. Making informed decisions becomes a norm.

Pros & Cons

Pros:

- Easy to navigate for all.

- Approve invoices on the move.

- Fits businesses of all sizes.

- Precise data capture.

- Supports multiple languages and currencies.

Cons:

- Lack of clear pricing on the website.

- Might be challenging for some.

- Some niche tools may not integrate seamlessly.

Pricing Plans

- Basic: For startups and small teams.

- Advanced: Catering to medium enterprises.

- Premium: Tailored for large organizations with complex needs.

Customer Ratings

- G2: 4.4/5

- Capterra: 4.6/5

Our Review

The user interface is clean and intuitive, making it easy to navigate. Plus, it offers good document management features, which help keep our files organized.

On the positive side, Yooz has efficient automation for invoice processing. This saves us time and reduces manual data entry errors. The approval workflow is handy too, keeping everything in check.

However, there are downsides. The pricing structure isn’t the most transparent, and costs can add up, especially for smaller businesses.

Also, customer support, while generally responsive, could be more proactive in addressing issues.

Consider it if you prioritize automation and organization in your financial processes.

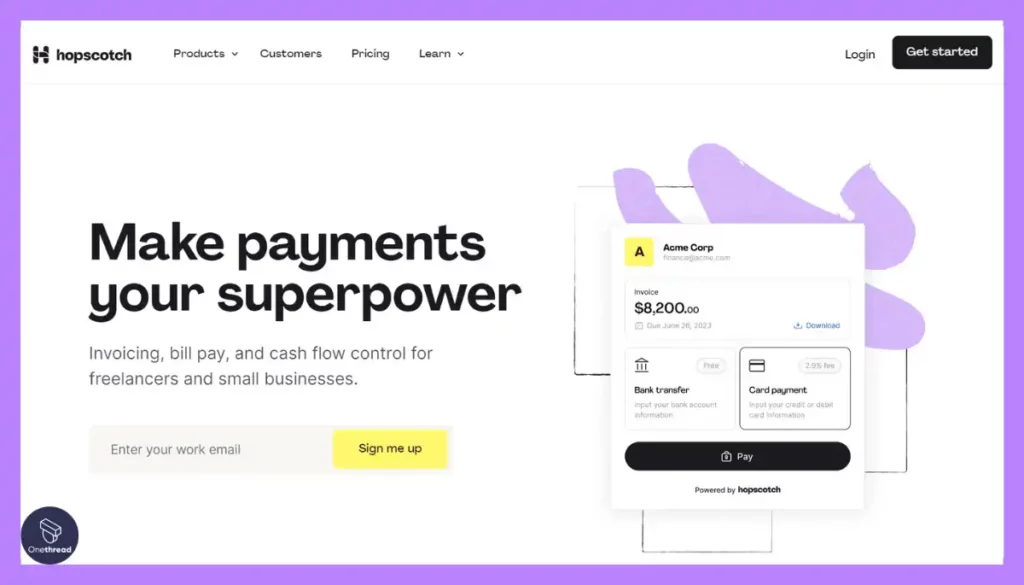

#4. Hopscotch

Hopscotch is your go-to online invoicing tool, designed for easy and efficient billing. Its user-friendly platform streamlines the invoicing process, making it a breeze for freelancers and small businesses.

With Hopscotch, you can create professional invoices, track payments, and send automatic reminders. The customizable templates allow you to showcase your brand, while the secure payment options ensure hassle-free transactions.

Hopscotch’s intuitive dashboard provides a clear overview of your financials, helping you stay organized. Whether you’re just starting or looking to simplify your invoicing, Hopscotch offers a credible and straightforward solution to meet your needs.

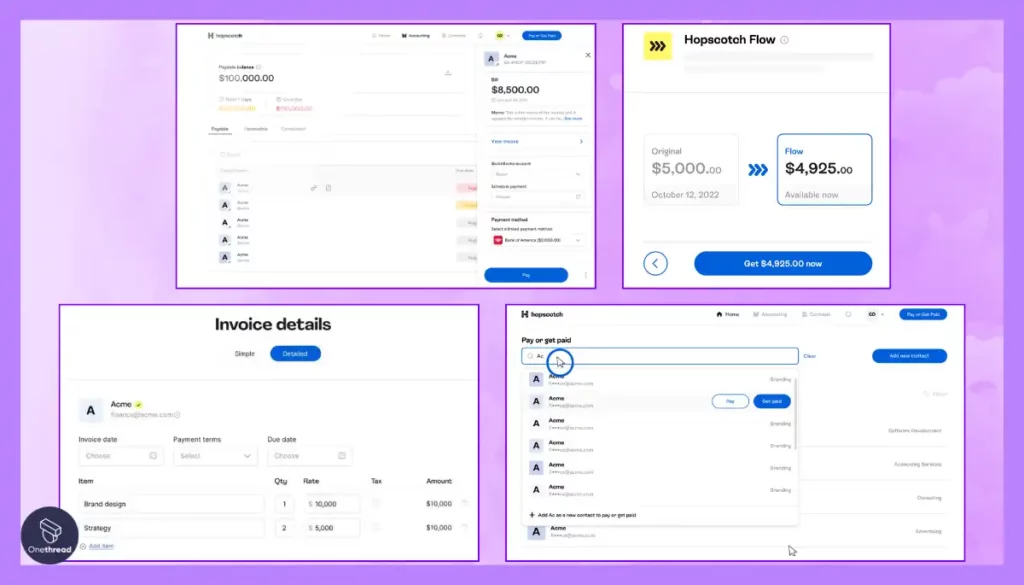

Features

Hopscotch isn’t just another tool. It’s an invoicing game-changer. With rising adoption, its influence is evident. Let’s dive deep into why this tool shines.

1. Intuitive User Interface

Hopscotch leads with design. Its interface is clean. Users find what they need fast. Navigating is a breeze. Efficiency and simplicity intertwine.

2. Robust Reporting

Data drives growth. Hopscotch understands this. Its reports are comprehensive. Users see income trends, late payments, and more. Decisions become data-backed.

3. Secure Payment Gateways

Security is paramount. Hopscotch guarantees it. Integrated payment gateways are robust. Encryption technology is top-notch. Transactions are safe, always.

4. Customizable Templates

Branding matters. Hopscotch delivers on this front. Invoices can be tailored. Brand colors, logos, and fonts are customizable. Impress clients every time.

5. Multi-Currency Support

Business is global. Hopscotch knows this. Users can invoice in multiple currencies. Exchange rates update in real-time. No manual calculations needed.

Pros & Cons

Pros:

- Syncs with popular accounting tools.

- Fast and helpful customer service.

- Paperless invoicing promotes green business.

- Log in from anywhere, anytime.

- Packed with features at competitive pricing.

Cons:

- Lacks some desktop features.

- Might challenge non-tech users initially.

- Limited functionalities without internet.

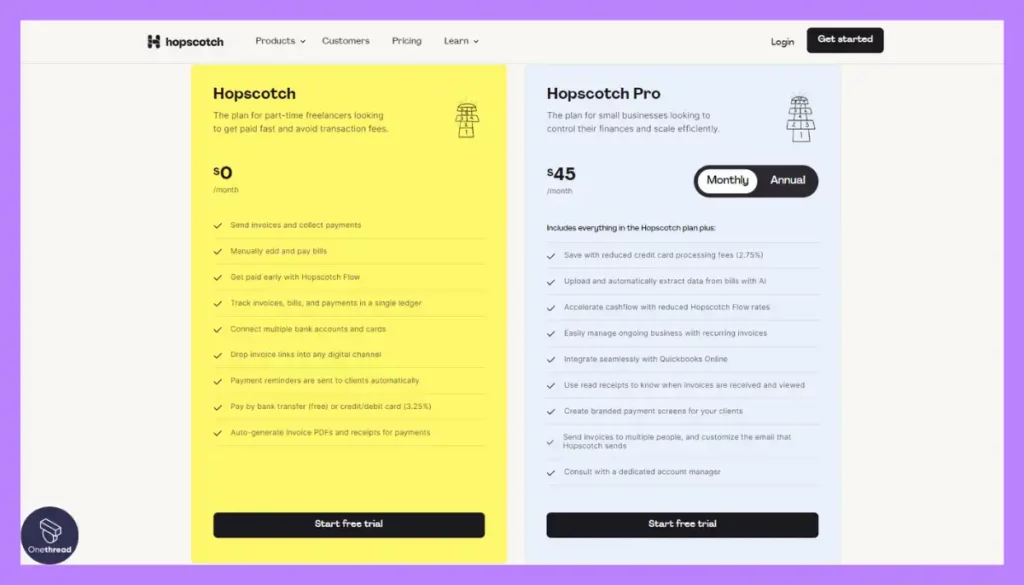

Pricing Plans

- Starter: For solo entrepreneurs.

- Professional: For growing businesses.

- Enterprise: For large teams with extensive needs.

Customer Ratings

- G2: 4.2/5

- Capterra: 4.5/5

Our Review

On the positive side, it’s a creative and engaging platform for teaching kids to code. We appreciate the user-friendly interface and the way it makes coding fun with games and interactive projects.

However, there are drawbacks. Sometimes, it can be a bit glitchy, causing frustration. Also, the free version has limitations, and you need a subscription for full access, which can get pricey.

Hopscotch is a valuable tool for introducing kids to coding in an enjoyable way. It has some technical hiccups and costs to consider, but it’s a solid choice for parents and educators looking to nurture coding skills in young minds.

#5. FreshBooks

FreshBooks simplifies accounting and invoicing for small businesses and freelancers. It’s an easy-to-use, cloud-based software designed to streamline financial tasks.

With FreshBooks, you can create professional invoices in seconds, track your expenses effortlessly, and manage your projects efficiently. It also offers time tracking features, ensuring you get paid for every billable hour.

The platform’s user-friendly interface makes it accessible even if you’re not a finance expert. It syncs with your bank account, keeping your financial data up to date.

FreshBooks is a reliable and credible tool for small businesses and freelancers looking to manage their finances without the fuss.

FreshBooks – Overview

- Focus: Cloud-based accounting and invoicing software for small businesses and freelancers.

- Company Valuation: $1B

- Employee Numbers: 720+

Founding Team:

- Mike McDerment:

- Position: Co-founder and former CEO.

- Joe Sawada:

- Position: Co-founder and former CTO.

- Levi Cooperman:

- Position: Co-founder and former CMO.

Features

FreshBooks isn’t new. But its impact is undeniable. A pioneer in online invoicing, it stands out. Its features are robust. Its reputation is strong. Let’s understand why.

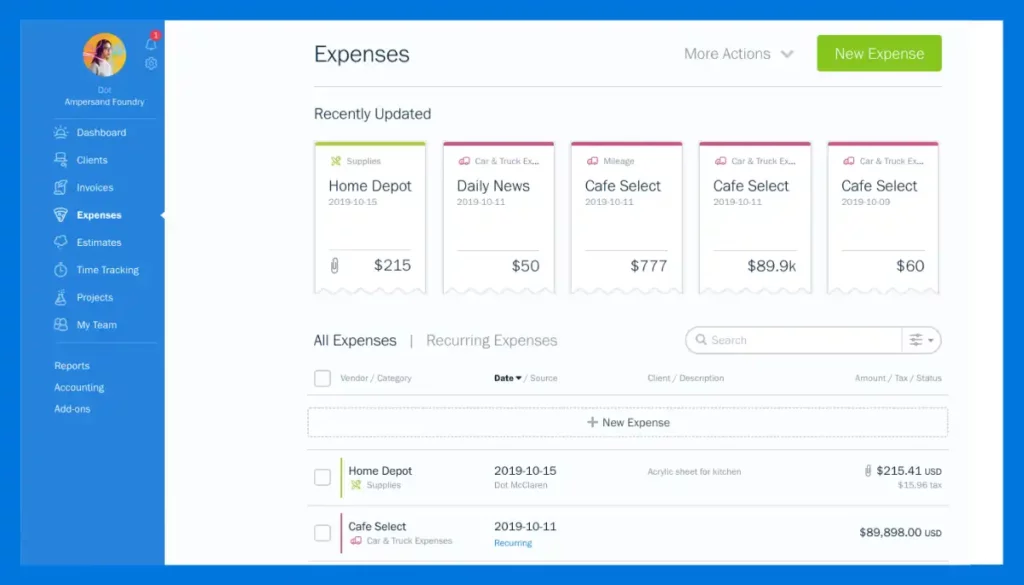

1. Automated Expense Tracking

Tracking expenses is key. FreshBooks makes it easy. Snap a photo of a receipt. The system logs it. Expenses are categorized. Reports are detailed.

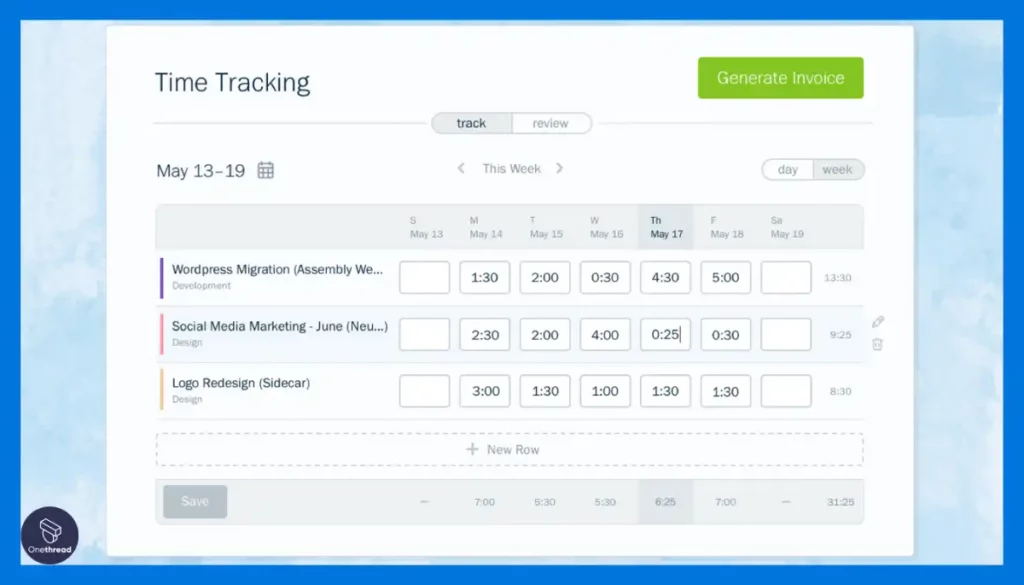

2. Time Tracking Integration

Time is money. FreshBooks believes it. Log hours directly. Bill clients for exact hours worked. No more guessing. Every minute counts.

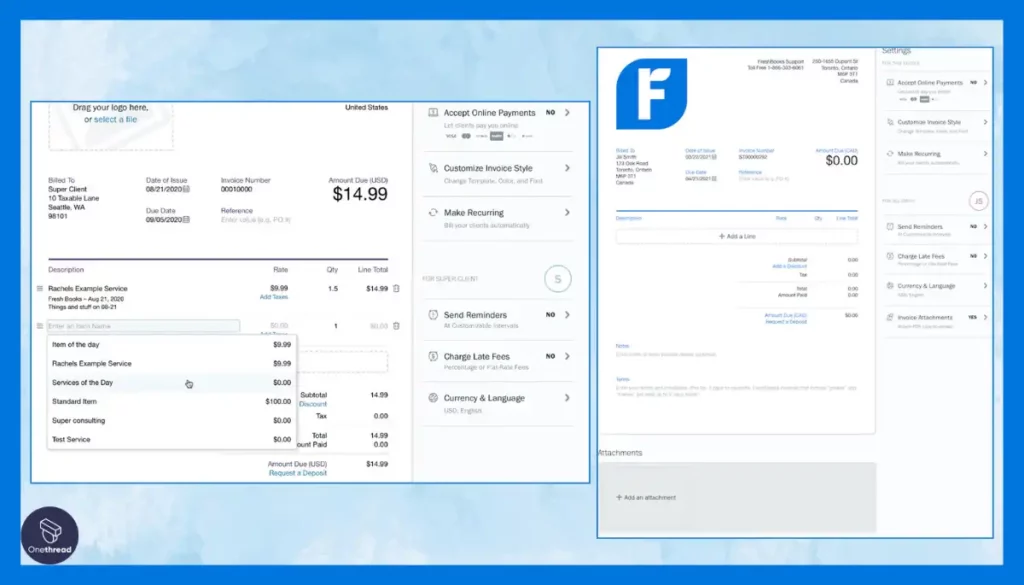

3. Custom Invoices

Branding sets you apart. FreshBooks ensures it. Create customized invoices. Add logos, colors, and personal messages. Make each invoice uniquely yours.

4. Recurring Payments

Some clients are regular. Billing shouldn’t be repetitive. FreshBooks automates it. Set it once. Let the system do the rest. Cash flow stays consistent.

5. Detailed Reports

Knowledge is power. FreshBooks offers insights. Understand business health. View profit, loss, and expenses. Make informed choices. Every time.

Pros & Cons

Pros:

- Suitable for non-tech users.

- Manage finances on the go.

- Clients view invoices, make payments.

- Data is encrypted and protected.

- Invoices in different languages.

Cons:

- Higher than some competitors.

- Works with selected third-party apps.

- Can overwhelm beginners.

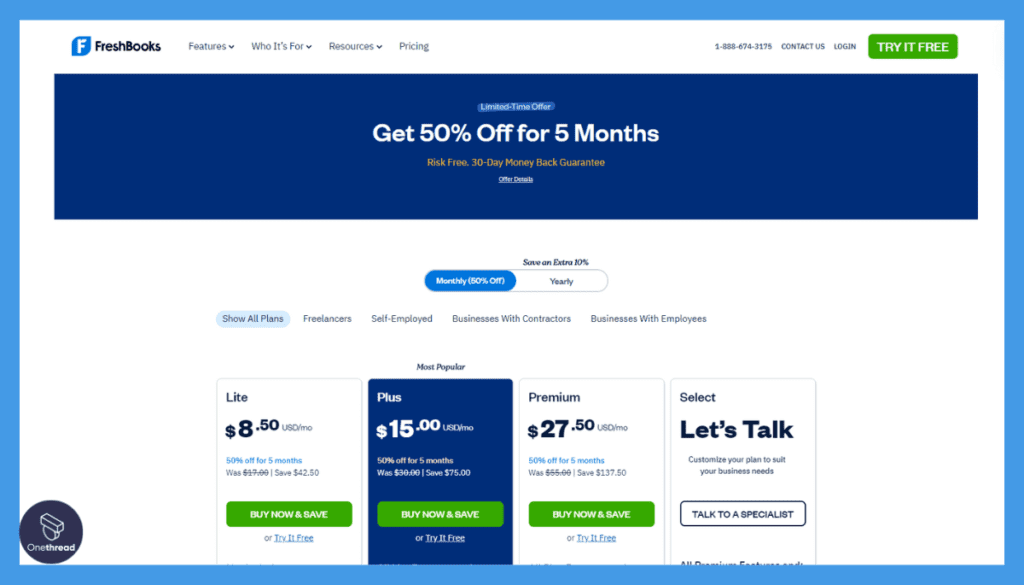

Pricing Plans

- Lite: For self-employed professionals.

- Plus: For small businesses.

- Premium: For larger teams.

Customer Ratings

- G2: 4.3/5

- Capterra: 4.5/5

Our Review

We appreciate its invoicing features, which help us get paid faster, and expense tracking is straightforward.

Moreover, FreshBooks offers excellent mobile access, allowing us to manage our finances on the go. Customer support is also responsive and helpful.

However, there are some downsides. The pricing can be a bit steep, especially for larger businesses with multiple users. Additionally, it lacks some advanced accounting features that larger businesses might need.

FreshBooks is a top choice for freelancers and small businesses. It’s user-friendly with robust invoicing but may not be ideal for larger enterprises due to its pricing and feature limitations.

Getting the Most Out of Online Invoicing Tools

Online invoicing tools are game-changers. But are you maximizing their potential? Tapping into their full power isn’t about just sending bills. It’s about optimizing your entire invoicing process. Here’s how:

- Consistent Branding: Customize templates to reflect your brand.

- Prompt Invoicing: Bill right after delivering services.

- Clear Terms: Specify payment terms and deadlines.

- Use Reminders: Automate follow-up reminders for late payments.

- Secure Your Data: Regularly backup invoices and client details.

- Review Reports: Analyze financial insights to improve business strategies.

- Integrate Tools: Sync with accounting or CRM software for efficiency.

With the right approach, online invoicing tools do more than just bill clients. They empower businesses, streamline processes, and drive growth. Dive in, and harness their full potential.

Conclusion

Online invoicing tools transform the billing process. They offer efficiency, accuracy, and professionalism in one package. As businesses evolve, so do their invoicing needs.

By adopting and maximizing these tools, companies can ensure timely payments, better cash flow, and more satisfied clients. In the digital age, smart invoicing isn’t just an option—it’s a necessity.

FAQs

Do they support multiple currencies?

Many leading invoicing tools offer multi-currency support, catering to businesses with international clients.

How do online invoicing tools differ from traditional accounting software?

While there’s overlap, invoicing tools specifically target billing processes, whereas accounting software handles broader financial tasks.

Do they offer automated reminders for overdue payments?

Most tools have a feature to send automated reminders to clients about overdue invoices.

Can I integrate online invoicing tools with other business software?

Many tools provide integration options with CRM, e-commerce platforms, and accounting software to streamline operations.

Is there a limit to the number of invoices I can send?

It varies. Some offer unlimited invoicing, while others might have a limit based on the chosen plan.